Claim Review Manual for Research and Technology Advisors – (Current)

We have found the current CRA version of the Claim Review Manual for Research and Technology Advisors to be difficult to navigate, so we have reproduced it here as a single page with a clear table of contents.

This version of the CRM is effective as of May 17, 2021, also available on the CRA website. The previous version (archived) is available here.

Claim Review Manual for Research and Technology Advisors

SR&ED Program

The Claim Review Manual cancels and replaces The Guide to Conducting a Scientific Research and Experimental Development (SR&ED) Review and Directive 2004-03 SR&ED Reports and is effective June 1, 2010.

CRM Table of Contents

Chapter 2.0: Overview and General Information

Chapter 3.0: Guidelines for Coordinated Review

Chapter 4.0: Planning the Review

Chapter 5.0: Conducting the Review

Chapter 6.0: Documenting the Review

Chapter 7.0: Finalizing the Review

Chapter 1.0: Introduction

1.1.0 List of Acronyms

| English Acronyms | English Acronyms Meaning |

|---|---|

| AAF | Accepted as Filed |

| AD | Assistant Director |

| AE | Account Executive |

| AIMS | The Audit Information Management System (AIMS) Online Guide discusses how to use it. |

| ASA | All or Substantially All |

| AP | Application Policy |

| ATIP | Access to Information and Privacy |

| AW | All Work |

| BC | Business Context |

| CF | Control Function |

| CICA | Canadian Institute of Chartered Accountants |

| CRA | Canada Revenue Agency |

| CRM | Claim Review Manual |

| CTSO | Coordinating Tax Services Office |

| FCRM | Financial Claim Review Manual |

| FR | Financial Reviewer |

| FRM | Financial Review Manager |

| FTA | Financial Technical Advisor |

| FTC | First Time Claimant |

| FTCAS | First-time Claimant Advisory Service |

| HQ | SR&ED Program Headquarters |

| IC | Information Circular |

| IFA | International Fiscal Association |

| IP | Intellectual Property |

| ITA | Income Tax Act |

| ITC | Investment Tax Credit |

| LFCM | Large File Case Manager |

| NOO | Notice of Objection |

| NTSS | National Technology Sector Specialist |

| NW | No Work |

| OAG | Office of the Auditor General |

| OC | Outside Consultant |

| PA | Privacy Act |

| PCPR | Pre-Claim Project Review |

| QA | Quality Assurance |

| RFI | Request for Information |

| RTA | Research and Technology Advisor |

| RTM | Research and Technology Manager |

| RTO | Research and Technology Officer |

| SALT | Self-Assessment and Learning Tool |

| STA | Scientific or Technological Advancement |

| STU | Scientific or Technological Uncertainty |

| SR&ED | Scientific Research and Experimental Development |

| SIS | Systematic Investigation or Search |

| SUE | Shared Use Equipment |

| SW | Some Work |

| TA | Technological Advancement |

| TGD | Technical Guidance Division |

| TC | Tax Centre |

| TPR | Taxpayer Requested Adjustment (amended claim) |

| TSO | Tax Services Office |

| UN | Unsubstantiated |

1.2.0 Purpose and Scope of the Claim Review Manual (CRM)

The CRM provides a comprehensive set of procedures for the Canada Revenue Agency’s (CRA) research and technology advisors (RTAs) to perform the technical review of scientific research and experimental development (SR&ED) claims. The CRM serves as a complete guide for the RTA in planning, coordinating (with financial reviewers), conducting and documenting the review of claims. Review procedures for FRs are described in the Financial Claim Review Manual (FCRM). The procedures in the CRM will help enhance consistency and quality in the review of claims among RTAs nationally. Consistency in this context is defined as follows: in similar circumstances, the RTA will follow the same or similar procedures to uncover the same facts on which to base a decision.

In addition, the CRM provides part of the basis for a quality assurance (QA) program that will ensure the proper application of the SR&ED legislation, policies and procedures, thereby contributing to the maintenance of the fiscal integrity of the SR&ED program.

By providing the means for consistent and fair treatment of SR&ED claims nationally, the CRM will help ensure that claimants receive their full entitlement allowed under the Income Tax Act. To improve the level of service to claimants, these procedures emphasize working with, informing and educating claimants on the many aspects of the SR&ED program. For example, within each chapter of the CRM, some highlighted boxes draw attention to numerous proven approaches for working effectively with claimants at each stage of the review process, which is especially important for first-time claimants (FTC). In addition, the CRM incorporates, where required, procedures for resolving claimants’ SR&ED concerns. These procedures help resolve disputes early in the review process and at the lowest level possible. All of these suggested approaches to help improve claimants’ compliance are based on best practices employed in various coordinating tax services offices (CTSOs). By working with claimants and objectively reviewing their claims, the CRA will be able to deliver SR&ED tax incentives sooner.

The procedures in the CRM begin when the RTA is assigned the SR&ED claim and end with the completion of the TF98 file. The CRM briefly discusses the control function (CF) and coding for files in the Audit Information Management System (AIMS) but does not cover detailed procedures for these subjects. The CRM also does not cover procedures for pre-claim project reviews (PCPRs), process reviews, account executive (AE) services, the first-time claimant advisory service (FTCAS), the random review program (RRP) or the financial review. Procedures for these topics are described in the relevant publications or the directives, accessible on the CRA Infozone.

The CRM does not provide comprehensive information on general CRA policy or non-CRA legislation such as those concerning security, confidentiality, health and safety. As a matter of convenience, the CRM provides some summaries of and links to important policies.

However, it is the responsibility of the RTA to know and follow all the current applicable policies and legislation with respect to these matters.

The CRM discusses procedures concerning some review issues, but it is not intended to discuss the definition of SR&ED or provide training on determining the eligibility of work.

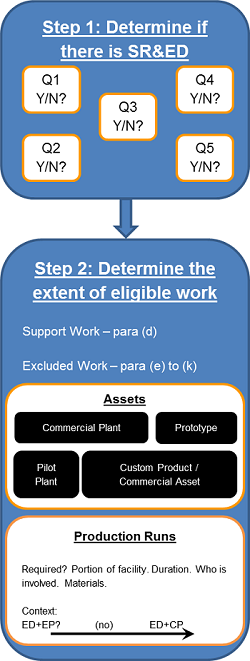

SR&ED is defined in the Act and explained in Eligibility of Work for SR&ED Investment Tax Credits Policy (eligibility policy). There are two other publications that relate to the eligibility of work: SR&ED while Developing an Asset Policy (asset policy), and SR&ED During Production Runs Policy (production runs policy).

A general reference guide for SR&ED employees is available at the SR&ED Reference Guide. This contains additional useful information for SR&ED employees, not just about the SR&ED Program.

1.2.1 Training courses for RTAs

(Reminder that the text below comes directly from the CRA website)

There are currently a number of courses for RTAs that deal with subjects not covered in the CRM.

Course TD 1170-000 is a basic training course for RTAs.

Course HQ1188-000 “Eligibility of work for SR&ED” is a three-day course covering the eligibility policy with case studies on this topic.

The following are one-day courses dealing with specific aspects of the review process;

- HQ1180-000 – SR&ED review report writing

- HQ1181-000 – Documentation and supporting evidence

- HQ1182-000 – Risk-based review process

- HQ1183-000 – Business context (BC) in the review process

The RTA’s manager will determine the appropriate time to take these courses. For more information on these courses, contact your manager.

1.3.0 Authority of the CRM

The CRM identifies the procedures that RTAs follow when reviewing SR&ED claims. Chapter 1.6.0 outlines the minimum (high level) requirements for all reviews. The other chapters outline how these minimum requirements generally apply to the procedures described in each chapter. The RTA is responsible for deciding what procedures to apply, or how to apply them in a particular situation, in order to meet these minimum requirements.

1.4.0 Terminology concerning requirements

While the CRM does not generally identify a specific procedure as being necessary to meet one of the minimum review requirements, certain terms may be used to provide guidance to the RTA. The CRM uses certain terms to describe three levels of latitude or discretion:

| Level of Latitude or Intended Meaning of the term | Term(s) used |

|---|---|

Requirement: The procedure is a requirement and there are no exceptions unless otherwise indicated, or

| Must, Required |

| Recommendation: The procedure is likely the preferred or best choice among possible alternatives in order to meet the minimum requirements. | Recommended, Should, Need |

| Possible Approach: The procedure is considered to be one possible practice or approach to meet the minimum requirements, and there are likely other practices that are equally valid or effective. | Can, Could, May, Might |

1.5.0 Due process / Taxpayer Bill of Rights

Due process is a fundamental requirement in the review of claims and means that the review is fair and impartial. While not specifically mentioned, the characteristics of due process follow from the CRA’s Taxpayer Bill of Rights. This subject is mentioned in many other places in the CRM. The requirements described in this chapter apply generally during all aspects of the review, particularly during “Conducting the Review” described in Chapter 5. Failure to give the claimant due process could result in the review process not being supportable, and thus the claimant could successfully challenge the CRA’s decisions at the notice of objection (NOO) stage (discussed in Chapter 2.6.0). Refer to the following link for more information on the Taxpayer Bill of Rights.

A claimant can still be given due process even if some steps or procedures in the CRM are not followed or are followed in a different order than presented. For example, if the RTA did not review certain documents during the on-site visit, the review of them at the proposal stage would correct that situation. Therefore, it is the treatment of the claimant as a whole, during the entire review process, which determines whether due process is given. Mostly, due process means treating the claimant with courtesy, respect, and fairness while applying the legislation and CRA policies correctly. If the RTA does all of the activities noted in this chapter, it will ensure that due process is given.

Eight characteristics of due process and the particular taxpayer rights that they derive from are as follows:

- provide service in the official language of choice; (Taxpayer right #2)

- explain the review process, issues and the planned approach to resolve them to the claimant; (Taxpayer rights #5,6,10)

- communicate the options available to the claimant if they do not agree with CRA; (Taxpayer rights #4,9)

- give the claimant information on the CRA requirements and explain what information the CRA needs to satisfy them; (Taxpayer rights #6)

- give claimants the opportunity to present their position, ask questions, express their concerns and to provide further information with respect to their claim; (Taxpayer rights #1,5,15)

- consider additional information provided in support of the claimant’s position before coming to a decision; (Taxpayer rights #1, 5, 15).

- explain decisions and the rationale to the claimant; (Taxpayer rights #5,6,9,11) and

- make decisions that are fair and impartial and respect current legislation and policy. (Taxpayer rights #1,8)

Details of the above steps are discussed in the appropriate places in the CRM. As will be noted, the specific details of what needs to be done depend on the particulars of each case and what the claimant already knows about the SR&ED program.

1.6.0 Minimum review requirements for RTAs

This chapter outlines the minimum requirements for any review of an SR&ED claim. These headings do not correspond to individual chapters in the CRM. Many of these requirements apply generally or in more than one aspect of the review. The requirements, as they apply in each part of the review, will be described in more detail in each chapter of the CRM.

List of requirements

1. General requirements:

Follow all CRA approved procedures concerning:

- communication of information to the claimant or their authorized representative;

- safety and security;

- information security;

- service in the official languages; and

- matters outside the scope of the CRM.

2. Documentation requirements:

- document all relevant review work (working papers), as well as keep other relevant supporting documentation related to the claimed work;

- do not document irrelevant personal opinions or irrelevant information about other claimants;

- prepare an SR&ED review report using the described format, or other working papers that explain the decisions and the rationale; and

- keep and organize working papers and supporting documentation in the TF98 file.

3. Requirements on consulting the research and technology manager (RTM):

- if there are contentious or problem situations;

- if there are questions about the application of policies;

- if referrals or outside consultation is needed;

- for approval of the review plan;

- for approval of important modifications to the review plan;

- if it is recommended that a claim will be disallowed for lack of information;

- if unfavourable decisions will be made without an on-site visit;

- if penalties may apply;

- if fraud is suspected;

- if formal better books and records letters are needed;

- for approval of the SR&ED review report; and

- if waivers may need to be used.

4. Requirements on coordinating the review:

- coordinate the technical review with the FR assigned to the claim.

5. Requirements on planning the review:

Prepare a written review plan, which includes the:

- scope of the review;

- major issues / concerns, and

- methodology or information required to resolve the issues / concerns.

6. Requirements on conducting the review:

- explain to the claimant the review process, issues and the planned approach to resolve them;

- communicate the options available to the claimant for resolving any of the issues;

- give the claimant information on the CRA requirements, including documentation requirements, and explain what information the CRA needs to satisfy them;

- give claimants the opportunity to present their position, ask questions, express their concerns and to provide further information with respect to their position;

- consider additional information provided in support of the claimant’s position before coming to a decision;

- make decisions that are fair and impartial and respect current legislation and policy;

- document key activities and observations concerning the claim, supporting information and the identified claim issues;

- for claimants who have previously received the FTCAS, determine if the recommendations of the FTCAS report have been addressed;

- document communications and meetings with the claimant, managers, co-workers and others that are relevant to the eligibility determinations and other decisions;

- obtain any documentation from the claimant necessary to support the eligibility determinations and other decisions; and

- do not negotiate eligibility or expenditures.

7. Requirements on finalizing the review:

- assist the FR in preparing the contents of the proposal letter package by providing any needed explanation of the proposed changes with respect to eligibility and any other technical issues;

- explain the proposed decisions with respect to eligibility or other technical issues to the claimant; and

- respond to any claimant’s concerns, rebuttal or additional information relating to the RTA’s decisions, as reflected in the proposal package.

1.7.0 Reference to the definition of SR&ED in the Income Tax Act

For the purposes of the CRM, where the context is clear, references to subsection 248(1) or paragraphs of subsection 248(1) of the Act, without any other qualifier, mean references to the definition of SR&ED in subsection 248(1) of the Act, or paragraphs of that definition.

1.8.0 Revisions of the CRM

The CRM will be updated and revised to ensure that it remains current. Feedback and suggestions from anyone who sees opportunities to improve the CRM is encouraged. Comments can be forwarded to SR&ED CRM.

Chapter 2.0 Overview and General Information

2.1.0 Summary of Chapter

This chapter provides general information about the claim review process, including information that applies to all audit-type work in the Canada Revenue Agency (CRA), not just scientific research and experimental development (SR&ED) reviews. The main sections cover:

- an outline of the SR&ED claim review process;

- an outline of the CRA information sources;

- special SR&ED terminology;

- an introduction to dispute resolution in the CRA;

- the legislated authority of CRA officials;

- the legislated requirements for taxpayers;

- procedures to follow when communicating with claimants;

- safety, security, and health considerations during a review;

- information security requirements; and

- service standards for the SR&ED claim review.

2.2.0 Requirements of Chapter

Following from Chapter 1.6.0, the research and technology advisor (RTA) must follow all CRA approved procedures and job requirements for:

- communication of information to the claimant or their authorized representative;

- safety and security;

- information security;

- service in the official languages; and

- consultation with the research and technology manager (RTM) in certain specified circumstances involving safety, security or difficulties with the claimant.

2.3.0 Outline of the Review Process

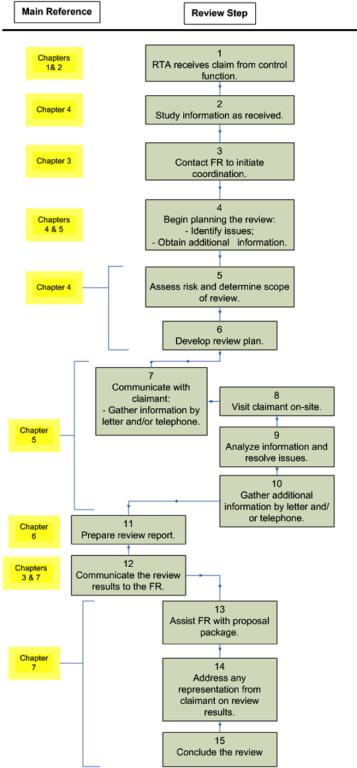

The following chart outlines the main steps in the review process and provides references to the main sections of the CRM that discuss each step. Note that the chart is a general guide only and does not cover every possibility or exception encountered during a review. The RTA should consult the CRM for details. The chart generally follows the usual steps of a review, but this does not mean that these steps must always follow this sequence.

Step 1: The RTA receives the claim from the control function (CF) (main references are chapters 1 and 2).

Step 2: The RTA studies the information as received (main reference is chapter 4).

Step 3: the RTA contacts the FR to initiate coordination (main reference is chapter 3).

Step 4: The RTA begins planning the review by identifying issues and obtaining additional information (main references are chapters 4 and 5).

Step 5: The RTA assesses risk and determines the scope of the review (main reference is chapter 4.).

Step 6: The RTA develops a review plan (main reference is chapter 4).

Step 7: The RTA communicates with the claimant, gathering information by letter and/or telephone (main reference is chapter 5).

Step 8: the RTA visits the claimant on site (main reference is chapter 5).

Step 9: the RTA analyzes information and resolves issues (main reference is chapter 5).

Step 10: the RTA gathers additional information by letter and/or telephone (main reference is chapter 5).

Step 11: The RTA prepares the review report (main reference is chapter 6).

Step 12: the RTA communicates the review results to the FR (main references are chapters 3 and 7).

Step 13: the RTA assists the FR with the proposal package (main reference is chapter 7).

Step 14: the RTA addresses any representation from the claimant on review results (main reference is chapter 7).

Step 15: the RTA concludes the review (main reference is chapter 7).

2.4.0 CRA Information Sources

2.4.1 Publications

Understanding CRA’s SR&ED documents and using them effectively during the technical review is critical. The SR&ED reference guide has links to key information. The following are the key reference materials needed to resolve review issues:

- The definition of SR&ED in subsection 248(1) of the Act;

- Eligibility of work for SR&ED Investment Tax Credits Policy (eligibility policy)

- SR&ED while Developing an Asset Policy (asset policy),

- SR&ED During Production Runs Policy (production runs policy), and

- T4088 – Guide to the Form T661.

There are also many other links to relevant policies, directives and guidelines in the CRM.

2.4.2 CRA Information Systems

Much information, including the tax centre (TC) risk assessment sheet, is available only from the internal CRA information systems referred to in the CRM. For tax years ending after 2008, claimants can file project information electronically, and the TC does not always print it. Therefore, the RTA may need to access the following systems, or have someone else access them, in order to review project information, verify authorized representatives, record delays, record the results of reviews and carry out other information management activities:

- audit information management system (AIMS) has information on current and past reviews and audits;

- CORTAX is the CRA system for accessing T2 (corporation) information as well as Form T661 prescribed information, including SR&ED project information (e.g., names of authorized representatives);

- RAPID is the CRA system for accessing non-T2 and other information; and

- SR&ED risk management tool is the information system where the RTA can access the initial risk assessment provided by the TC.

The CRA has given RTAs a profile that identifies the particular information systems and levels that they are authorized to access. Local offices manage access profiles.

2.5.0 Special Terminology

2.5.1 Control Function

The Control Function (CF) is the function in each CTSO that receives/ screens SR&ED claims referred to them from the TC. The CF decides if the claim must be reviewed in more detail by the RTA or the FR, or both.

2.5.2 SR&ED project and activity

The CRM uses the word “project” frequently. Although the Act does not define or use the term “project”, form T661 requires SR&ED work to be claimed as SR&ED projects. The CRM will use the term as defined in the eligibility policy:

“Every project claimed must fall within the definition of SR&ED in subsection 248(1) of the Act. An SR&ED project is defined as a project comprising a set of interrelated activities that:

- collectively are necessary in attempting to achieve the specific scientific or technological advancement defined for the project by overcoming scientific or technological uncertainty; and

- are pursued through a systematic investigation or search in a field of science or technology by means of experiment or analysis performed by qualified individuals.”

A project may consist of one or more activities. An activity is therefore an element of work within a project. Chapter 4.6.2 discusses how to address situations when not all the claimed activities are part of an SR&ED project.

2.5.3 “Eligible” and “Ineligible”

The terms “eligible” and “ineligible” (including the forms “eligibility” and “ineligibility”) are widely used in the SR&ED program, although the Act does not define these terms. For the purposes of the CRM, “eligible”/ “ineligible,” without any other qualifier, means work which meets/ does not meet the definition of SR&ED in subsection 248(1) of the Act.

2.5.4 “Determination”, “Conclusion”, and “Decision”

The term “determination’ is used in the CRM to mean the result of the technical review conducted by the RTA with regard to whether the claimed work meets or does not meet the definition of SR&ED in subsection 248(1) of the Income Tax Act. The RTA’s determinations will include situations where:

a. all of the reviewed work meets the definition of SR&ED (AW);

b. some of the reviewed work meets the definition of SR&ED and some does not (SW); and

c. none of the reviewed work meets the definition of SR&ED (NW).

The term “conclusion” is used with this meaning: the RTA “concludes” that the claimed work is unsubstantiated (UN). This situation occurs when the claimant is unable to provide sufficient evidence to substantiate the claimed work and so, it is not possible for the RTA to determine if the claimed work meets the definition of SR&ED in subsection 248(1) of the Income Tax Act.

The term “decision” is used with respect to the RTA’s work that does not relate to the definition of SR&ED. It includes “decisions” concerning joint technical-financial issues. It also includes cases when the RTA decides to accept as filed (AAF) all or some of the claimed work without conducting a review to determine if the claimed work meets the definition of SR&ED in subsection 248(1) of the Income Tax Act. The decision to AAF the claimed work means that the CRA has neither confirmed nor refuted the eligibility of the claimed work.

2.5.5 Desk, On-Site, Limited and Detailed Reviews

These terms are used when coding the RTA’s work in AIMS. More information on this subject can be found in the AIMS online guide.

2.6.0 Dispute resolution, notices of objection and appeals

2.6.1 Dispute resolution

During the review process, the claimant may not agree with decisions made by the RTA. Because dispute resolution is important to the CRA and the SR&ED Program, a process for dealing with disagreements has been developed and described in Application Policy (AP) 2000-02R “Guidelines for Resolving Claimant’s SR&ED Concerns” and is applicable to RTAs when they conduct reviews. It describes a three step process whereby the claimant is encouraged to talk first with the RTA or FR to resolve disputes, second to talk with the RTM or financial review manager (FRM), and third to request an administrative second review (ASR). Other procedures and approaches recommended for the RTA for effectively resolving claimant concerns are presented in Chapter 5.

2.6.2 Notices of objection and appeals

At various places in the CRM, there are references to notices of objection (NOO) and appeals to the Tax Court of Canada. The following website contains details on the CRA formal dispute resolution process: Complaints and disputes.

Disputes that are not resolved to the satisfaction of the claimant during the review can be resolved via a more formal process that begins after a notice of assessment/ reassessment is issued to the claimant. In the case of amended claims, sometimes a reassessment is not issued and the process is different. Directive 1997-02 Scientific research and experimental development (SR&ED) – Requests for investment tax credit (ITC) refunds has details.

In most cases, a claimant must file a NOO within 90 days of the “Notice of Assessment/Reassessment.” Claimants can file an objection by using the My Account feature on the CRA Internet site or by writing to the chief of appeals at their appeals intake centre. The file then becomes the responsibility of the CRA’s Appeals Division who does an impartial review. Sometimes the RTA is involved in this process. Refer to the Stakeholder Relation Division in SR&ED Headquarters (HQ) for a more detailed discussion of this review process. Refer to Appendix A.6 for a discussion of some specific considerations for dealing with files where there is a NOO or appeal, and when the RTA may be involved in the appeals review process.

If the claimant still disagrees with the outcome of the appeals decision, they have the right to file an Appeal to the Tax Court of Canada. The Tax Court of Canada publishes their decisions and they are available from a number of sources such as the Tax Court of Canada website and Knotia News. RTAs can subscribe to Knotia News using this link in order to receive copies of published judgments.

When objected to by the claimant, the RTAs decision can be reviewed by other branches of the CRA and by the Tax Court of Canada. It is important that the RTA follows the principles set out in the CRM so that the decisions are appropriately documented and supportable.

2.7.0 Legislated authority of the RTA to conduct reviews

Subsection 231.1(1) of the Act provides the legislated authority for authorized CRA staff to conduct reviews, and the RTA is an authorized person under this section of the Act. The RTA is issued an RC121A authorization card indicating that they are so authorized. The following extract from the CRA audit manual section 4.5.1 states the following about the card:

“Auditors are provided an RC121A authorization card that outlines that the person named on the card is authorized to carry out the following functions under the relevant provisions of the ITA and the ETA:

- enter a place of business,

- enter a personal residence where required with the occupant’s consent,

- require persons on the premises to give assistance and to answer questions,

- require a person to accompany them where legally provided,

- examine and copy documents,

- examine property.

Entering a personal dwelling without the occupant’s permission is expressly forbidden under the legislation unless a judge has issued a warrant that authorizes entering the dwelling.

The legal name as shown on the authorized person’s birth certificate or other official document (certificate of name change, marriage certificate, certificate of Canadian citizenship) should be shown on the RC121A authorization card. A new authorization card must be issued when a person legally changes their name.

The RC121A authorization card must not be used as a personal identification card or for any purposes for which it is not intended. It must be kept separate from the employee’s building identification and should never leave the employee’s possession. Any requests to photocopy it must be denied for security reasons but taxpayers/ registrants may copy the wording by hand. A lost or stolen card must be reported immediately as a security incident and a security incident report must be completed.

The status of authorized person is not restricted to CRA employees. For example, an outside consultant (OC) can also be an authorized person, but the CRA normally gives this authorization on a file-by-file basis, and it is limited by the terms of the contract. Chapter 4.7.3.1 contains more information on OCs.

Chapter 5.10.0 discusses of procedures for dealing with problems concerning entering the claimant’s premises, conducting the review or obtaining information from the claimant.

2.8.0 Legislated requirements for taxpayers and compliance

2.8.1 Requirement to provide information

Section 231.1 of the Act allows CRA officials to inspect, audit, review or examine the books and records of a taxpayer and any document of the taxpayer or of any other person (including third parties) that relates or may relate to a taxpayer’s books and records that may be relevant to the administration or enforcement of the Act. This is discussed in greater detail in Chapter 5.4.2 of the CRM and Chapter 10.6 of the audit manual.

Section 231.1 requires anyone (not just the taxpayer) to provide documents or information needed to administer the Act, although, in practice, requests from third parties are not routinely made. Under the provisions of subsection 231.5(1) the RTA can require a taxpayer to make copies of documents.

Information requests made under Section 231.2 of the Act are known as requirements. A requirement is a legal document issued by the CRA that compels a taxpayer/registrant or third party to provide information and/or documents under this section. This is discussed in Chapter 5.12.3. Requirements have a force of law equivalent to a court order but should be used only when necessary. Failure by the recipient to comply with a requirement could result in prosecution.

Accountant’s and authorized representative’s working papers relate to a taxpayer’s books and records, and CRA officials have the legal authority to request such working papers at any time during an inspection, audit or examination for any purpose relating to the administration or enforcement of the Act.

Provisions in the Act provide the CRA with many legislated compliance tools that enable an official to request or require information for verification and administrative purposes.

Chapter 5.4.0 contains a discussion of the procedures for acquiring information from claimants and third parties. This chapter also lists the applicable Compliance Programs Branch (CPB) Communiqués that discuss CRA policy and the legislated compliance tools.

Chapter 5.10 and 5.11 discuss procedures for dealing with claimants who fail to provide information.

2.8.2 Requirement to maintain records and books

Subsection 230(1) of the Act requires that taxpayers keep records and books

…in such form and containing such information as will enable the taxes payable under this Act or the taxes payable or the taxes or other amounts that should have been deducted, withheld or collected to be determined.

The Act defines records as follows:

‘record’ includes an account, an agreement, a book, a chart or table, a diagram, a form, an image, an invoice, a letter, a map, a memorandum, a plan, a return, a statement, a telegram, a voucher, and any other thing containing information, whether in writing or in any other form.

This definition is broad enough to include the kinds of supporting evidence claimants need to substantiate an SR&ED claim. Chapter 5.6.6 has more details.

Subsection 230(3) of the Act allows the CRA to require a taxpayer to keep adequate records and books if they have failed to do so. Subsections 238(1) and 238(2) outlines the consequences of failing to keep adequate books and records. Chapter 5.11.3 discusses procedures for dealing with problems of inadequate records and books.

2.9.0 Contact and communications with the claimant

2.9.1 General considerations

All RTAs must know and follow the CRA policy on communications security for protected information. All forms of contact must adhere to CRA information security protocols. Please note that the CRA communication policy is currently under review.

The key points of CRA’s policy are:

- cell phone contact and email with the claimant are not considered secure and must be avoided when dealing with technical issues or other protected information.

- Protected and classified information must not be sent via email, even if the taxpayer specifically requests and authorizes it.

- Taxpayers must be advised not to send any of their personal information to the CRA by email.

- As email received from taxpayers cannot be authenticated and can be intercepted and altered, individuals should remind taxpayers not to transmit their personal information to the Agency using unsecure email.

- It is possible to exchange emails with other CRA staff. However, these emails must respect the confidentiality provisions of section 241 of the Act and CRA security policies. Protected information can be exchanged by email only within the CRA, and it must be encrypted by CRA approved means. According to the CRA Protected Information Policy paragraph 5.6, the “Public” network consists of facsimile machines without encryption devices enabling information to be received from taxpayers. It can also be used to send to taxpayers documents that specifically concern them, but only if the taxpayer provides satisfactory identification (in accordance with existing Taxpayer Services standards) and have specifically requested a reply by facsimile. The identification standards are in TOM 3980 – Confidentiality of Taxpayer services – individual programs).

2.9.2 Authorizations / contact with the claimant

While the RTA is authorized to speak to anyone in order to obtain information for purposes of reviewing a claim, the RTA has no authority to provide information about a claim to any individual who is not authorized by the claimant to receive that information.

When the RTA initially contacts the claimant, the first person to contact is the technical contact person listed in Box 115 of Form T661. This person may refer the RTA to other people within the company in order to answer questions or arrange meetings. If the contact person is not an employee, or refers the RTA to someone outside the company, the RTA must ensure that an authorization is on file before speaking to them. If there is no authorization on file, the RTA must contact the company (the contact person or the person who signed the T661) advising them to Add An Authorized Representative online via their CRA My Business Account.

Alternatively, the RTA can check the Business Number System to identify the owner or authorized representative and the limits to the authority of the authorized representative (such as the years, time limits, and whether it applies to a firm or a single individual), but sometimes this is not up to date. The most recent communications from the company owner are the most accurate. If a new authorized is received, the RTA should put a copy in the files and send the original to the TC so that Business Number System may be updated.

The RTA must be vigilant when a third party is requesting or wishes to discuss confidential information. Even when the claimant makes a verbal request to authorize a third party, an authorization must be indicated in the CRA Business Number System or completed and signed by the claimant and in possession of the CRA before the third party request can be satisfied. The RTA may contact a person who is not the owner or an authorized representative to obtain information about a claim, but it does not mean that any information regarding the review or the claimant’s tax matters can be divulged to that person. It is important to remember to discuss confidential information only with the claimant or their authorized representative. Confidential information must not be disclosed to an unauthorized person according to the provisions of Section 241 of the Act. Chapter 5.4 discusses obtaining information from third parties.

The RTA should work with the authorized representative to schedule interviews and meetings with the claimant’s personnel. However, at the beginning of every review, the RTA should confirm with the claimant the communication protocol preferred by them (such as information requests, scheduling of interviews, communication of results), and emphasize the importance of timely responses to queries made to both the claimant and the authorized representative. Discussing these expectations with the claimant at the outset of the review will help to avoid potential communication problems.

2.9.3 Official languages

Communications with claimants must follow the provisions of the Official Languages Act.

2.9.4 Claimant’s representatives

Claimants frequently use the services of tax professionals to prepare their tax returns and act on their behalf with the CRA. Claimants may also hire representatives to write the project descriptions as well as assist them during the claim review. The claimant’s representatives may be present during meetings and may answer questions on behalf of the claimant.

The choice to use a representative is right #15 of the Taxpayer Bill of Rights and must be respected by the RTA. However, that right does not negate the RTA’s right to obtain information they need or the right to directly contact anyone they need about the claim, which includes the claimant or the scientists or engineers having responsibilities for the claimed work. For example, if the RTA cannot obtain needed information through a representative, the RTA can go directly to the claimant. A claimant representative does not have the right to restrict the RTA from access to information or people that the Act permits. In fact, sections 231.1 and 231.2 of the Act give the RTA the authority to require anyone to provide information or documentation. If problems arise with the representative, such as miscommunication or undue delays, and the claimant has asked that all communications be sent via the representative, the RTA must discuss this with the RTM and document the facts before contacting the claimant directly. When a claimant has an authorized representative, the RTA should discuss with the claimant whether they want verbal and written requests for information to be sent to the representative or not.

2.9.5 Access to Information and Privacy (ATIP)

Two Acts are relevant to the disclosure of information, including the information generated in the course of the review of SR&ED claims. The Access to Information Act deals with the rights of access by the public to information under the control of the Government of Canada. The Privacy Act protects personal information and gives individuals rights of access to their personal information held by the government.

For more information about ATIP, including discussion of what does not have to be released and the RTA’s obligation to keep the information he/she created, refer to the Access to Information and Privacy Directorate website.

2.9.5.1 Informally requested information

Claimants can make a formal ATIP request for information in their tax file, or informally by simply asking the RTA or their manager. According to the Access to Information and Privacy Directorate, the informal method is considered to be the preferred method of access for claimants to their tax file, and a response should be provided if possible. The response depends on whether the file is currently under review or not.

If an SR&ED file is currently under review, informally requested information may be disclosed after a proposal letter is issued to the claimant.

If an SR&ED file was reviewed, (re)assessed and sent back to the TC, the files may be borrowed from the TC, copies made and the informally requested information disclosed to the claimant.

All ATIP and informal information requests should be coordinated through the RTA’s manager to ensure consistency in handling them. Most of the TF98 file and the audit file could be released to claimants after the review is completed, but some important information must not be released.

Examples of information that may be released include:

- T2020, financial report and SR&ED review report;

- external and internal correspondence, including memoranda, appropriately severed where necessary;

- related correspondence with headquarters (for example, technical interpretation requests or opinions and referrals); and

- audit working papers, excluding third-party information, leads, disclosure of audit techniques, and information from informants.

Examples of information that cannot be released include:

- business numbers, names and addresses of secondary files;

- information obtained in confidence during an audit that may prejudice the results of the audit, such as Criminal Investigation reports, Royal Canadian Mounted Police reports, or documents obtained as part of an investigation;

- audit verification techniques and specific audit guidelines;

- information about investigations in process when a decision is pending;

- documents of a related file under investigation;

- confidential information about another taxpayer;

- Department of Justice correspondence and information under solicitor-client privilege, including legal opinions from the Legal Services Branch. For more information, go to “Disclosing legal opinions” and “Use of legal opinions inside the Agency” on the Legal Services Branch Guidelines webpage;

- accounts of consultations and deliberations involving officials or employees of a government institution or minister of the Crown that if disclosed, may reasonably be expected to cause injury or restrict the CRA’s ability to administer the Act;

- copyrighted material; and

- printouts from CRA computer systems. Instead, transcribe relevant information from the printout and include in a letter to the claimant.

2.10.0 Safety, Security & Health Considerations

2.10.1 Introduction

As noted in Chapter 1, the CRA policy summaries in the following section do not eliminate the RTA’s responsibility to follow all applicable legislation and current CRA policy.

In any potentially dangerous situation, the RTA’s safety must be the first priority. CRA employees must remove themselves from any threatening situation. CRA employees must protect themselves at all times to ensure their own safety and that of their families, together with the safety of their fellow employees and the claimant. Such situations cannot be predicted but the RTA, along with their RTM, can use their experience and best judgement to identify potentially threatening situations when conducting reviews. To do this, the RTA must know and follow CRA work procedures, preventative measures, guidelines and the related reporting requirements. Currently, these include:

- Canada Labour Code, Part II;

- CRA Occupational Health and Safety Policies; and

- Abuse, Threats, Stalking and Assaults against Employees Policy (Security Volume, Finance and Administration Manual).

In addition, the RTA must:

- request guidance and assistance from managers, if required, when it is necessary to call on and confront difficult individuals; and

- report any threats or abuse immediately to the managers, to Security and to the police.

The CRA offers the Employee Assistance Program as a service to employees in dealing with a variety of concerns, whether personal or work-related.

2.10.2 Requests by a claimant to video or audio record

Although claimants and their representatives may take notes during a meeting, the RTA must not consent to being recorded by any video or audio recording equipment. If the RTA discovers that the claimant is recording a meeting, they must immediately terminate the meeting, and inform the claimant that CRA management will be in contact with them to discuss the issue and make other arrangements. The RTA must then immediately inform the RTM of the situation.

2.10.3 Offensive or threatening interviews

In later chapters, the CRM provides suggestions and best practices for managing reviews that are difficult. However, if during the course of the review, the claimant’s or their representative’s language or behaviour becomes offensive or intimidating, and the business purpose of the meeting cannot reasonably be achieved, the RTA must:

- calmly suspend or terminate the interview;

- consult the RTM to decide on appropriate measures to be taken; and

- prepare a written report of the incident for management, detailing all relevant facts.

When the potential for assault exists and the RTA’s safety appears to be at risk, the RTA must:

- not restrain or agitate the person or persons;

- vacate the premises immediately;

- use best judgement on how to secure personal safety and protection if unable to leave, such as calling for help using a cellular phone or attracting attention of other people nearby;

- call the police as soon as possible, if assaulted, follow their instructions, obtain a medical examination from a qualified physician, and alert the RTM and security as soon as possible (the threat reporting number is 1-866-362-0192); and

- prepare a written incident report (using Form RC166) for management of the incident, detailing all relevant facts.

2.10.4 Demands for personal information or other information

If requested by the claimant, the RTA must present their CRA RC121A authorization card and explain to the claimant the reason for, the nature of and legal authority for their review. However, the RTA must never provide any personal information such as a home phone number or address, or produce personal documents like a driver’s license. The RTA can also show the claimant their government identification card, but if this does not satisfy the claimant, the claimant can speak to the RTM. If the claimant continues to demand other irrelevant information, and those demands hinder the RTA from performing their duties, they must terminate the meeting. The incident must be reported immediately to the RTM. The RTA can submit to normal company security procedures (such as baggage searches and reasonable requests for information), if this is standard for all visitors. If there is any concern about the nature of the procedures, the RTA should contact the RTM.

2.10.5 Questionnaires, forms and non-disclosure agreements

Claimants might ask the RTA to fill out questionnaires or forms before allowing them access to the records and premises. The RTA must not, under any circumstances, complete questionnaires, forms, or other non-CRA documents. The RTA must inform the RTM that the claimant made such a request. This restriction does not, however, prevent the RTA from such routine practices as signing the visitors’ log identifying their name and organization. If the RTA is not sure whether the information should be provided, they should contact their RTM.

Some claimants are concerned that their confidential information may be divulged inappropriately and may request that the RTA sign a non-disclosure agreement before allowing access to the records and premises. When faced with this concern, the RTA must not sign the agreement. Instead, the RTA must inform the claimant that section 241 of the ITA includes strict confidentiality provisions that, if breached, will result in fines and/or incarceration. In addition, the RTA must inform the claimant that all federal public servants, including them, have appropriate security clearance and have taken the Oath of Office and Secrecy and swore or affirmed that they would not disclose any information they may become aware in the course of the exercise of their duties.

A refusal by the claimant to allow the RTA to conduct a review because they have refused to sign a form will be dealt with by first informing the RTM of the situation. If the claimant continues to prevent the RTA from conducting a review, the RTA must communicate to the claimant in writing to explain that the claim will consequently be disallowed.

2.10.6 Health and safety during on-site visits

The CRA has developed a number of policies, standards, regulations and guidelines concerning employee safety and health to ensure protection from exposure to occupational hazards and environmental conditions and factors. As mentioned earlier in Chapter 1, the RTA must know and follow applicable legislation and CRA policies.

Some of the important points from these policies are:

- Becoming aware of any potential health or safety risks prior to visiting the claimant’s premises is an essential part of planning an on-site visit. By asking for information from the claimant on necessary or advisable precautions, such as the need for a facemask, hearing protection or steel-toed boots, the RTA can assess their safety needs and act accordingly. The RTA should consult the RTM for more details.

- Pay particular attention to plan for safety when preparing to travel to and from the claimant’s premises. Under no circumstances is it necessary to travel when unsafe or risky travel conditions (for example, icy roads, snowstorm, limited visibility) prevail along the travel route. When travelling by car, and road conditions are poor, the RTA must always try to find out if these conditions might remain poor or worsen.

- If during an on-site visit the RTA believes that the working conditions or premises are not safe, they cannot access the site safely or that they cannot continue to conduct the review safely, they must terminate the on-site visit immediately. RTAs must not put themselves into a situation that they feel is unsafe and they must remove themselves from any unsafe situation that develops. The RTA must then contact the RTM to discuss their health and safety concerns, preferably prior to making a decision, where possible.

- The RTA should discuss any other health and safety concerns with the RTM. The RTA can also consult the Treasury Board Guidelines on Occupation Health and Safety if they need further information.

2.11.0 Information Security

The RTA must know CRA security policies and must follow them when they receive, share, transport or transmit sensitive information. The Security Volume – Finance and Administration Manual discusses CRA security policy. The policies described there are the CRA standard and take precedence over any other instructions or requirements in the CRM. Additionally, the RTA must follow the security guidelines published by the Program Support and Integrity Division. As mentioned in Chapter 1, the summaries provided in this chapter are not the complete policy. The summaries do not eliminate the RTA’s responsibility to know and follow all current CRA policy.

The following is a summary of the main points of the CRA policies:

- The CRA must protect the confidentiality of client information and manage its use and disclosure in accordance with privacy and access to information laws and confidentiality provisions of legislation it administers. Client information will only be used for the purpose for which it was obtained or the purpose for which the information was legally disclosed to CRA. See Client Information for details.

- The CRA considers most of the information used by the RTA to be sensitive and classifies it at the “Protected B” level. This includes all information that has the potential to identify a particular claimant, whether directly or indirectly. Information sent to claimants, such as proposal letters and information requests, is Protected B, and steps such as verifying the address on the BN systems must be taken to avoid misdirection. Ensure that no information from other claimants is present before sending a letter. Use clean templates instead of modifying existing letters. In addition, as per a CRA policy, replace the first six digits of any SIN with X’s on letters sent to claimants.

- Information security is vital in the CRA, and the RTA must, as a general rule, exercise good judgement and ensure that every reasonable effort has been made to safeguard protected information or assets at all times. If the RTA has any doubts about how to handle a situation or any concerns about security in general, they must consult the RTM for guidance.

- As specified in Appendix A of Chapter 9 of the FAM, Security Volume, when in transit, employees must secure protected information and/or assets they are carrying in a locked briefcase or container. The RTA must tag the briefcase or container with forwarding or return address information and/or the phone number of the RTA’s office.

- Paper files and assets are only to be in vehicles during the conveyance between the employee’s residence, place of work and claimant’s place of business. While travelling by vehicle, employees are to secure classified and/or protected information and/or assets in a locked briefcase. The briefcase must be of a type approved by the CRA for the type of information or assets, and the RTA must place it in a locked trunk or out of sight in a locked vehicle. Placement of the briefcase or container and / or the asset must occur at the time of departure from the employee’s residence, place of work or claimant’s place of business. The RTA must make every reasonable effort to plan the itinerary to eliminate or minimize stopovers before reaching a final destination. However, if brief unforeseen or planned stopovers are necessary (for example, lunch, convenience store, or daycare), the RTA must exercise good judgement and make every reasonable effort to minimize the risk to the protected information and/or assets.

- Information classified at higher than Protected “B”: The RTA must never leave Classified and / or Protected C information in a vehicle unattended. The RTA who must store protected information and/or assets such as a laptop or notebook computer at a claimant’s residence or place of business must do so in an approved container, or in an approved filing cabinet provided by the claimant, on which they can fasten an approved Agency combination padlock. The RTA must also secure the container or filing cabinet in a locked room. The CRA does not consider a briefcase an approved container when left on claimant’s premises;

- As specified in Transmittal and Transport of Protected and Classified Information and Assets Standards of the Finance and Administration Manual, Security Volume, when in transit, employees must secure protected information and/or assets they are carrying in a locked briefcase or container. The RTA must adequately safeguard protected information during transmittal by mail. The key point of the policy is that the RTA must send all protected information and assets through a CRA mailroom. Mailrooms have established security-approved procedures for transmittal within and outside the CRA.

- Transmittal and Transport of Protected and Classified Information and Assets Standards of the Finance and Administration Manual, Security Volume also discusses transmission of protected information via fax. That document indicates that Protected A and B information may be communicated to the claimant by fax (no encryption device required), but only upon verification of the claimant’s identity and only at the express written request of that claimant.

- For tracking and security purposes, the RTA must, for internal transmission of TF98 files, use a T973 Routing Advice of Controlled Shipment Tracking form. This form tracks “controlled shipments” between CRA offices that contain protected material. Those forms are available through all CRA mailrooms.

2.12.0 Service standards and the complete claim date

The CRA is committed to certain service standards for the processing of SR&ED claims. The service standards were determined by calculating reasonable lengths of time to process SR&ED claims, based on the normal steps involved. The CRA has committed to achieving these standards 90% of the time.

The RTA must take into consideration the CRA service standards when planning and conducting a review. The four service standards are:

-

current refundable claims (claim type 2337 for corporations, un-assessed returns with 35% ITC) , 120 days;

-

claimant requested adjustments of refundable claims (claim type 0402 for corporations, assessed returns with 35% ITC) , 240 days;

-

current non-refundable claims (claim type 0450 for corporations, assessed returns with 20% ITC) , 365 days; and

-

claimant requested adjustments of non-refundable claims (claim type 0452 for corporations, assessed Returns with 20% ITC), 365 days.

Service standards webpage has more information on service standards.

The CRA determines the number of days to process SR&ED claims from the date the TC considers the SR&ED claim complete until the date the claim is sent back to the TC for (re) assessment. Both of these dates are recorded in AIMS.

If the claimant’s actions or requests result in a delay of the review of the claim, the number of days available to review the claim is lengthened by the duration of the delay. These delays are entered in AIMS.

The process to initiate and approve the use of a delay code is set by the individual CTSO and should be followed by the RTA. In all cases, the reasons for placing the delay must be indicated in the file. Directive 2003-03 Use of Delay Codes on AIMS contains complete information.

When planning the review, note that the time allotted is for the complete review, not just the technical review. The RTA should complete their work early enough to allow sufficient time for the FR to review the SR&ED review report, perform the financial review of expenditures claimed, prepare the proposal package, and for the TC to complete the (re)assessment.

If any RTA believes, for any reason, that he cannot review the file within the applicable service standard, the RTA should advise the responsible RTM.

Chapter 3.0 Guidelines for Coordinated Review

3.1.0 Summary of chapter

This chapter introduces and discusses guidelines linked to a coordinated review between the research and technology advisor (RTA) and financial reviewer (FR). Specifically:

- A definition is provided.

- Its characteristics are discussed.

- Ways to coordinate are discussed.

- The benefits for both the Canada Revenue Agency (CRA) and the claimant are discussed.

3.2.0 Requirements of chapter

Following from Chapter 1.6.0, there are two requirements that apply equally to both the RTA and the FR:

- All reviews must be coordinated between the RTA and the FR.

- Relevant interactions must be documented.

3.3.0 Background

The underlying principles of coordination between the RTA(s) and the FR also apply to SR&ED claims that have been assigned to both an RTA and an FR. The principles also apply to other situations where consultation and sharing of information leads to more effective and more efficient services, such as process review, pre-claim project review, first-time claimant advisory service (FTCAS), account executive service, or outreach services (such as information seminars). FTCAS in particular is deigned to be provided jointly by the RTA and FR.

In general, depending upon the specific issues identified in the review plan, a coordinated review may be done by applying the relevant guidelines outlined below. Most of the guidelines reinforce the need for discussion with the other reviewer (the RTA or FR) for the purposes of planning reviews, coordinating activities, and monitoring progress on the file. When appropriate, the research and technology manager (RTM) and / or financial review manager (FRM) may need to participate in the discussion and resolution of issues related to the claim.

It is preferable if the FR and the RTA can receive the file at the same time to facilitate timely planning and coordination of efforts.

3.3.1 Definition of coordinated review

A coordinated review is one which is undertaken using an approach whereby the RTA and FR and, when needed, their respective managers, discuss and determine the principal issues of the claim and arrange to coordinate their respective activities throughout the review. For example, when a review is coordinated, the RTA and FR will consult and communicate with each other on the following relevant items:

- the scope of their reviews, including the need for an on-site visit;

- joint issues in the claim that require the input of both reviewers to resolve, and the planned approach to resolve those issues;

- responsibilities for initiating contact with the claimant, and mechanisms for obtaining and then sharing pertinent information with the other reviewer;

- significant events (such as planned leave and changes to availability) or occurrences (new priorities and decisions to abandon the review) that may impact the work plan, or may provide milestone or status information on the review process;

- contemplated significant revisions to the review plans of the RTA or the FR. In the CRM, the words “review plan” may also refer to a joint review plan;

- on-going findings of review work performed, especially as they impact joint issues;

- adjustments each reviewer will be proposing and representations / additional information received from the claimant;

- sources of delays that affect the review process;

- content of communications with the claimant;

- the SR&ED review report and the proposal letter so that feedback from the other reviewer can be sought and provided prior to mailing to the claimant; and

- any other information that affects the review process of the other reviewer, or that affects the completion of the file on a timely basis.

Coordinated reviews are required in all cases when both the RTA and the FR receive their parts of the file at the same time. A coordinated review allows both reviewers more flexibility in how and when to perform their work.

A joint review, on the other hand, is one where the FR and RTA work in tandem, and all work on the file, including meetings with the claimant, planning and correspondence is conducted with the concurrent participation of both reviewers. Joint reviews are encouraged, especially with large files, but are not required. The CRM does not discuss procedures for a joint review as they are considered part of the more general coordinated review.

In summary, a coordinated review is a collaborative and supportive process using on-going communication as its primary tool, which resolves joint or overlapping issues and assists each reviewer to manage and meet their own review objectives efficiently and effectively.

3.3.2 Characteristics of coordinated review

There are two objectives of performing a coordinated review:

- to improve the efficiency and effectiveness of the claim review by encouraging improved communication between the RTA and FR; and

- to reduce the administrative burden on the claimant and minimize the interruption to their business operations (for example, coordinating requests for information and a site visit).

Each reviewer should undertake to assist the other reviewer on joint issues identified in the review plan, and to inform the other reviewer of all relevant developments that could affect the other reviewer’s review process. These responsibilities to one another and ultimately to the overall review process would normally be evident in the file through documentation showing that sufficient relevant interactions occurred to meet the two stated objectives of a coordinated review.

Typical interactions of a coordinated review:

- Early in the review process, the FR and the RTA communicate the scope of their planned review to each other. They discuss and decide which common issues require coordination of review procedures.

- Each reviewer shares relevant information they have concerning the claim or claimant with the other reviewer.

- The reviewers discuss their information needs with respect to reviewing the claim. Opportunities for improving efficiency of the review may result where both reviewers would otherwise examine the same or similar information independently or seek different information from the same source. For example, both might want a cost breakdown by project.

- The reviewers decide on the most appropriate and effective manner for obtaining information from the claimant. This avoids asking the claimant for the same information twice and may eliminate the need for a second visit.

- The reviewers discuss and coordinate the need for an on-site visit to the claimant.

- The reviewers update each other on the progress and status of their respective reviews. This could include updates concerning:

- the scheduling of meetings with the claimant;

- information requests issued and information received;

- interim findings by the RTA on project eligibility;

- new issues uncovered during the review;

- changes or modifications to the review plan or to the scope of the review;

- the inadequacy of the claimant’s documentation or books and records;

- anticipated internal delays (for example, leave plans); and

- the time anticipated by each reviewer to complete their review.

- The reviewers communicate in a timely manner any other information that is discovered which could have an impact on the other reviewer’s review process. This would apply particularly for information of the sort discussed under “joint technical-financial issues” in the CRM for RTAs.

- The RTA provides the SR&ED review report to the FR for examination and feedback. Any comments provided by the FR are addressed prior to sending the report to the claimant. This ensures that nothing of importance to the financial review has been overlooked in the SR&ED review report. Within this context, the RTA ensures that the SR&ED review report does not include decisions on strictly financial issues. Nevertheless, the RTA still provides commentary on any potential financial issues when the RTA has concerns or reservations resulting from information received from the claimant or otherwise. This commentary only puts forward factual comments and relevant observations that will assist the FR in making decisions on their issues. For example, the RTA comments on the role of an employee performing SR&ED, or the time or period spent by that person on a project, but does not comment on whether that person is a “specified employee”. The RTA could, however, note in their report that the employee stated that they were a shareholder of the corporation.

- If the services of an outside consultant (OC) are required for the review, the RTA responsible for the OC regularly updates the FR on the OC’s progress on the review. A copy of the OC’s report is provided to the FR for comments before it is sent to the claimant as an attachment to the RTA’s SR&ED review report.

- The FR may need to access information in the TF98 file for the current or prior tax years and therefore needs access to any such information not keyed on CORTAX. How this is done is left to the coordinating tax services office (CTSO) management to determine and implement. It is recognized that geographical distances between CTSO and tax services office (TSO) may encumber movement of the TF98 file to the FR;

- The FR and the RTA communicate to each other delays set or removed in AIMS on a timely basis.

- If gross negligence penalties are considered, the FR and the RTA work together and inform their managers, prior to communicating with the claimant.

- The RTA and the FR should strive to visit the claimant together to discuss contentious issues so that the claimant may better understand the potential impact of the review on the investment tax credits (ITCs) claimed.

- The FR provides the proposal letter to the RTA, prior to providing it to the claimant.

- The FR and the RTA present their results in a proposal package that includes both the eligibility and the financial changes to avoid delays associated with multiple claimant responses. However, it is understood that under certain circumstances it is preferable that the RTA sends a preliminary SR&ED review report to the claimant prior to the proposal package, such as when there is a significant delay between the completion of the technical and financial reviews. The decision to send a preliminary SR&ED review report is at the discretion of the RTA and local management.

When an issue in the file is strictly financial or technical, the RTA or FR will resolve the issue without involving the other reviewer. However, coordination is particularly useful for the review of a number of joint issues and situations, for example:

- work and related expenditures – to determine if an expenditure was incurred for SR&ED may require a decision by the RTA as to whether the expenditure claimed is reasonable in light of the SR&ED work that was performed. It may also require a decision in respect of the context of the expenditure;

- salaries – to determine if an expenditure was incurred for SR&ED may require a decision by the RTA as to whether or not the employee was directly engaged in the identified SR&ED work or otherwise directly attributable;

- materials – to determine if an expenditure was incurred for SR&ED may require a decision by the RTA as to whether the materials claimed were “consumed” or “transformed” in the prosecution of SR&ED and whether all or substantially all (ASA) of the quantity claimed was consumed or transformed;

- SR&ED contracts – to determine if a contract expenditure was incurred for SR&ED may require a decision by the RTA as to whether the contractor or subcontractor (performer) performed SR&ED and whether that SR&ED was performed on behalf of the claimant;

- equipment – to determine if a capital expenditure was incurred for SR&ED may require a decision by the RTA whether it was intended that the equipment would be used ASA for, or that ASA of its value would be consumed in SR&ED. It may also require a decision in respect of the actual use of the equipment in a case of shared use;

- prototypes and pilot plants –to determine if an expenditure was incurred for SR&ED may require a decision by the RTA as to the actual use or intended purpose and use of the property by the claimant; and

- experimental production versus commercial production with experimental development contexts (EP+ED vs. CP+ED) to determine if an expenditure was incurred for SR&ED may require a decision by the RTA as to the context of the production run claimed.

3.3.2.1 Working with claimants in the coordinated review

All of the coordinated review practices discussed in Chapter 3 act to benefit both the CRA and the claimant. From the claimant’s perspective, coordinated reviews are more coherent, timely and less burdensome. An integral part of ensuring that coordinated reviews work for both the CRA and the claimant is to solicit the claimant’s input to ensure that the review can be completed efficiently. This is even more important in situations requiring significant travel by the RTA, FR, or employees and representatives of the claimant.

A number of specific practices are noted below that will help to demonstrate the CRA’s commitment to working with the claimant in order to ensure that all parties benefit from a coordinated review.

If either the RTA or the FR is familiar with the claimant, either through previous reviews or preliminary research, they must share that information as it may affect the review plan or the quality of service to be provided. Sharing this information between the RTA and the FR reduces the number of questions that the claimant is asked. Prior to the meeting, once the RTA and the FR have agreed upon the review plan, they together can plan the initial contact with the claimant, either by phone or via the initial contact letter, to determine or confirm:

- the timelines and anticipated on-site time requirements to complete the review;

- the means (letter or telephone) by which the CRA will request information, and to whom in the claimant’s company the request will be sent;

- time frames for responding to any CRA request or query so that the timeline for completing the review can be met;

- how and when updates on the progress and outstanding issues will be communicated between the CRA and the claimant; and

- mechanisms for resolving any concerns of the claimant.

During the review, when deficiencies in documentation or understanding of eligibility of work are noted, the RTA and FR should offer the claimant suggestions for improvements to their documentation thus providing them with a consistent message on the expectations of the CRA. A consistent message will enhance the claimant’s understanding of the SR&ED program and improve their working relationship with the CRA.

Chapter 4.0 Planning the Review

4.1.0 Summary of chapter

This chapter discusses how to plan for the review, and some special situations that might affect the review. This chapter covers the following activities:

- identifying the important claim issues or concerns;

- managing risks;

- preparing a written review plan;

- developing a strategy to deal with claims that include a large number of projects;

- dealing with special situations or circumstances that could affect the review;

- identifying and gathering missing or additional information;

- studying and analyzing materials provided by the claimant and from other sources;

- developing suitable methods to resolve review issues.

4.2.0 Requirements of the chapter

The following requirements apply to this chapter. The research and technology advisor (RTA):

- plans the technical review, and coordinates the planning with the financial reviewer (FR).

- makes a written review plan (the only exceptions are described in Chapter 4.8.0) with the following key elements:

- identification of issues and / or applicable projects to be reviewed;

- scope of the review, based on the risk assessment and other factors; and

- proposed review strategy and methods for review.

- consults the research and technology manager (RTM):

- to determine if a review plan is not needed;

- for approval of the review plan;

- if referrals or formal consultation are needed; and

- if there are any concerns about the results of referrals.

- documents:

- all relevant communications with respect to the review;

- revisions to the review plan; and

- referrals, their results, and what was done with the advice or guidance received.

- the review and provides a rationale for the determination(s)/ conclusion(s)/ decision(s)

- follows general Canada Revenue Agency (CRA) requirements for:

- communications and information security; and

- handling claimant information (do not write on or alter original documents from the claimant).

4.3.0 Risk management

The course HQ 1182-000 Risk-Based Review Process is available to RTAs. It describes the risk-based review process and how to use it in conducting reviews. This section summarizes the key points of this course.

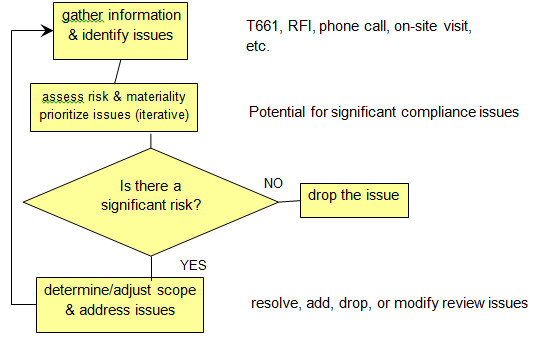

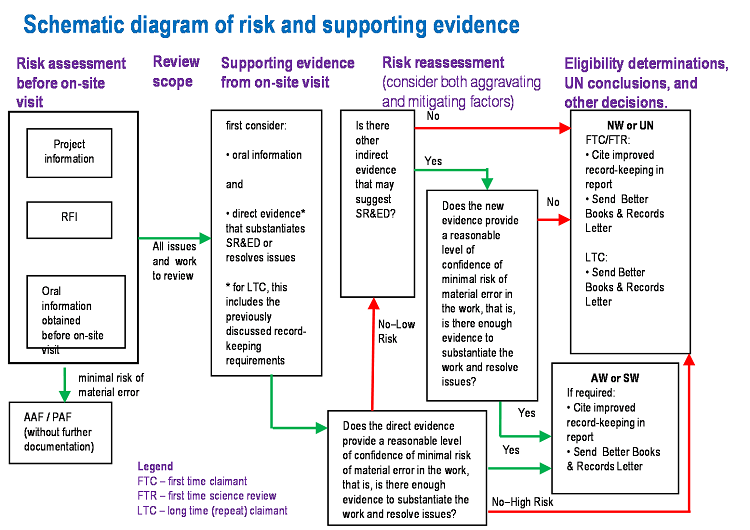

Risk management is an important aspect in all of the CRA’s operations. In the Scientific Research and Experimental Development (SR&ED) Program, using risk assessment techniques is crucial to selecting claims for review and to determine the scope of review. Properly conducted risk assessments identify files with the greatest potential of non-compliance and thus allow for efficient use of resources. It helps prevent doing unnecessary reviews of compliant claimants, thereby increasing the overall efficiency and effectiveness of the SR&ED Program.