Québec’s New Provincial R&D Tax Credits: Here’s What Businesses Need to Know

As Québec rolls out the Québec CRIC tax credit, many companies wonder: what happens to SR&ED? What are the changes? Will refunds shrink, and will two claims now be needed?

The Minister of Finance, Eric Girard, delivered Budget Speech 2025‑2026 on March 25, 2025, in which the Québec government introduced a new tax incentive: the Tax Credit for Research, Innovation and Commercialization (CRIC). The Québec CRIC tax credit is designed to simplify the province’s innovation support system and replaces a complex suite of existing credits, including the provincial component of SR&ED.

“The new tax assistance system for innovation will come into force for corporate taxation years that begin after the day of the budget speech [March 25, 2026]. — The abolished tax credits can be claimed for corporate taxation years that began no later than on the day of the budget speech.”1. This means that the SR&ED Reporting deadline for businesses, under the abolished tax credit, is September 25, 2026. See our article on Filing Late – Will it Impact SR&ED? – SR&ED Education and Resources.

Quebec SR&ED Tax Credits (Outdated – Prior to March 25, 2025)

Until the announcement on March 25, 2025, Quebec offered several refundable tax credits to support research and development (R&D) activities, primarily aimed at Canadian-controlled private corporations (CCPCs). Key programs included:

- Tax Credit for Salaries and Wages (RD 1029.7):

Up to 30% refundable credit on eligible R&D salaries and wages paid to employees. - Tax Credit for University Research or Research Carried Out by a Public Research Centre (RD 1029.8.6):

Up to 30% refundable credit for eligible expenses incurred under research contracts with eligible universities and public research centres. - Tax Credit for Private Partnership Pre-Competitive Research (RD 1029.8.16.1):

Up to 30% refundable credit for eligible expenses related to collaborative, pre-competitive R&D projects undertaken through qualified private partnerships. - Tax Credit for Fees and Dues Paid to a Research Consortium (RD 1029.8.9.03):

Up to 30% refundable credit for amounts paid to eligible research consortia to support collaborative R&D efforts.

For most of the above credits, the refundable rate began to gradually decline once a corporation’s total assets exceeded $50 million. This scaling mechanism adjusted the credit rate based on the size of the corporation rather than the amount of R&D expenditures claimed, thereby targeting greater support toward small and medium-sized enterprises (SMEs).

These credits were a key part of Quebec’s broader innovation strategy, offering strong financial incentives for companies to invest in research, build collaborations, and drive technological advancement. Following the March 25, 2025 announcement, major reforms were introduced, and companies engaged in R&D activities in Quebec should ensure they are aware of the new rules and program structures now in effect.

Provincial Québec CRIC tax credit – What has changed?

The Québec CRIC tax credit is a fully refundable tax credit that aims to support R&D and pre-commercialization efforts. It will replace the existing SR&ED provincial tax credits in Quebec and will cover: Labour costs, Equipment purchases, and 50% of subcontract amounts with universities, public research centers, or research consortia. The basics include:

- Fully refundable ITCs: “The refundability of the CRIC will enable all businesses to benefit fully from the amount of assistance they are entitled to in a taxation year, regardless of their tax payable for the year.”2

- Assistance rate based on expenditure levels, not on business size: “To better support initial innovation expenditures, CRIC rates will be adjusted according to the level of expenditures rather than corporation size [as per the abolished tax credit], namely: — a rate of 30% for the first million dollars of eligible expenditures in excess of an exclusion threshold; — a rate of 20% for eligible expenditures in excess of the $1-million limit.”3

- Pre-commercialization expenditures become eligible: Pre-commercialization is defined as “work carried out in conjunction with basic research, applied research or experimental development, such as tests, prototyping and technological validation.”4 “The eligibility of these pre-commercialization activities will make it possible to support projects that have reached a more advanced level of technological maturity and thereby contribute to the objective of fostering the development of innovations and intellectual property that can be commercialized out of Quebec.”5

- Subcontractor costs eligibility: As of the 2025–2026 budget, the eligible portion of subcontracting costs for SR&ED claims has been standardized to 50%, regardless of the type of subcontractor (university, Centres collégiaux de transfert de technologie (CCTT), or contract research organization). Previously, rates varied- 80% for universities or CCTTs, and 50% for contract research organizations.6

- Capital expenditures allowed: “In order to better support Québec’s technology sectors in acquiring the equipment needed for their work and to create an environment that is more conducive to innovation, eligible expenditures for the CRIC will include, in addition to salaries and wages, those related to equipment used in eligible R&D and pre-commercialization activities.”7. “As these expenditures are not currently eligible for the federal government’s SR&ED tax credit, the related CRIC assistance will not affect the amount of federal tax assistance.”8

- Exclusion threshold less restrictive: Starting in 2025, the exclusion threshold for eligible R&D salaries is set to the higher of (i) $50,000 or (ii) the basic personal amount ($18,571 for 2025) multiplied by the number of employees and their percentage of time spent on eligible R&D. This replaces the previous fixed thresholds of $50,000 for small-and medium-sized businesses (SMBs) and $225,000 for large businesses and is designed to better align support with higher-value R&D jobs.9

- Focused on Quebec Corporations/Partnerships: To increase the economic and tax benefits generated by R&D tax assistance in Québec, a corporation will need to operate a business in Québec and have an establishment there to be eligible for the CRIC.

- “Currently, the terms and conditions of Québec’s R&D tax credits stipulate that a corporation must carry out, or have carried out on its behalf, R&D activities in Québec, operate a business in Canada, and have a permanent establishment in Canada.

- In its current form, Québec tax assistance can therefore be granted to a corporation that has no establishment in Québec and pays no Québec taxes.”10

This change will direct tax assistance to Québec-based corporations and enhance the province’s innovation ecosystem.

Additional Support for Businesses

Additionally, with the creation of the Québec CRIC tax credit, eligible corporations might apply for the Incentive Deduction for the Commercialization of Innovations in Quebec (IDCI). The IDCI “enables a qualified corporation to benefit, for a taxation year beginning after December 31, 2020, from an effective tax rate of 2% on the qualified portion of its income attributable to the commercialization of a qualified intellectual property [IP] asset (hereinafter referred to as a “QIPA”).”11

The deduction becomes more beneficial as the proportion of IP-related income increases relative to the company’s total revenue. To qualify, the corporation must: 1. Operate an active business with an eligible establishment in Québec, and 2. Generate income from the commercialization of qualifying IP assets, such as: A patented invention or one protected by a supplementary protection certificate, copyrighted software, or A plant variety protected under plant breeders’ rights.

The budget change has raised a crucial question for Québec-based businesses:

Does CRIC replace the provincial SR&ED credit, and what does that mean for the total refund rate?

The answer is yes, and the eligibility criteria are expanding in terms of what can be claimed (ex. Capital expenditures). Let’s walk through the information and implications.

Changes to the Provincial RTCs

The federal Scientific Research and Experimental Development (SR&ED) program, administered by the Canada Revenue Agency (CRA), remains unchanged. The change applies to Québec’s tax credit, which previously mirrored the SR&ED program but is now being replaced by the new Québec CRIC tax credit. These credits are not filed separately with different agencies, they continue to be submitted together through the standard filing process.

The Québec CRIC tax credit replaces/abolishes the following measures:12

- Replaces the four Provincial R&D tax credits:

- Refundable tax credit (RTC) for researcher salaries and wages (RD-1029.7)

- R&D RTC for university research (RD-1029.8.6)

- R&D RTC for private partnership pre-competitive research (RD-1029.8.16.1)

- R&D RTC for contributions and fees paid to a research consortium (RD-1029.8.9.03)

- Replaces the RTC for an in-house design activity (industrial design component)(CO-1029.8.36.7)

- Replaces the RTC for technological adaptation services (CO-1029.8.21.22)

- Abolishes the Tax holiday for foreign researchers and Tax holiday for foreign experts.

Visual Comparison Chart: SR&ED (Previous System) vs. CRIC + SR&ED (New System)

| Feature | Previous System (Québec + Federal SR&ED) | New System (CRIC + Federal SR&ED) |

| Federal SR&ED Credit | ✔️ Remains available | ✔️ Still available (no changes) |

| Refund Rate – Federal portion | Up to 35% | Up to 35% |

| Refund Rate – Québec portion | ~14% – 30% | CRIC: 30% (on 1st $1M), then 20% above that |

| Total Potential Refund (theoretical combined) | ~49% – 65% | ~55% – 65% (varies by claim mix & structure) |

| Eligibility | Mostly R&D expenses | R&D plus pre-commercialization and commercialization expenses |

| Capital Expenditures (Québec) | ❌ Excluded since 2014 | ✅ Restored eligibility under CRIC + broader scope. |

| Expenditure Thresholds | Exclusion threshold of $50K for SMBs and $225K for large businesses | Exclusion threshold to the greater of $50K or the total of the “R&ED employees threshold” and the “pre-commercialization employees threshold”. |

| Program Complexity | 8+ overlapping tax credits | One unified CRIC replacing multiple programs |

📌 Notes:

- The CRIC 30% rate applies only to eligible expenses up to $1 million. Above that, the rate drops to 20%. The rate is now based on the amount of eligible expenses, rather than the corporation’s size.

- The federal SR&ED process remains unchanged, so companies still file with the CRA and must meet CRA’s eligibility criteria.

- The exclusion threshold amount for an employee represents the basic personal amount under the personal income tax system (e.g., $18,571 in 2025) adjusted to the proportion of their time spent carrying out eligible R&D or pre-commercialization activities.

Will My Total Refund Drop from ~65% to ~30% with the Québec CRIC tax credit?

It depends on how you currently claim your tax credits.

Today, a Québec-based SME eligible for both federal SR&ED and provincial refundable SR&ED might receive a combined refund rate of around 60–65% of eligible expenses.

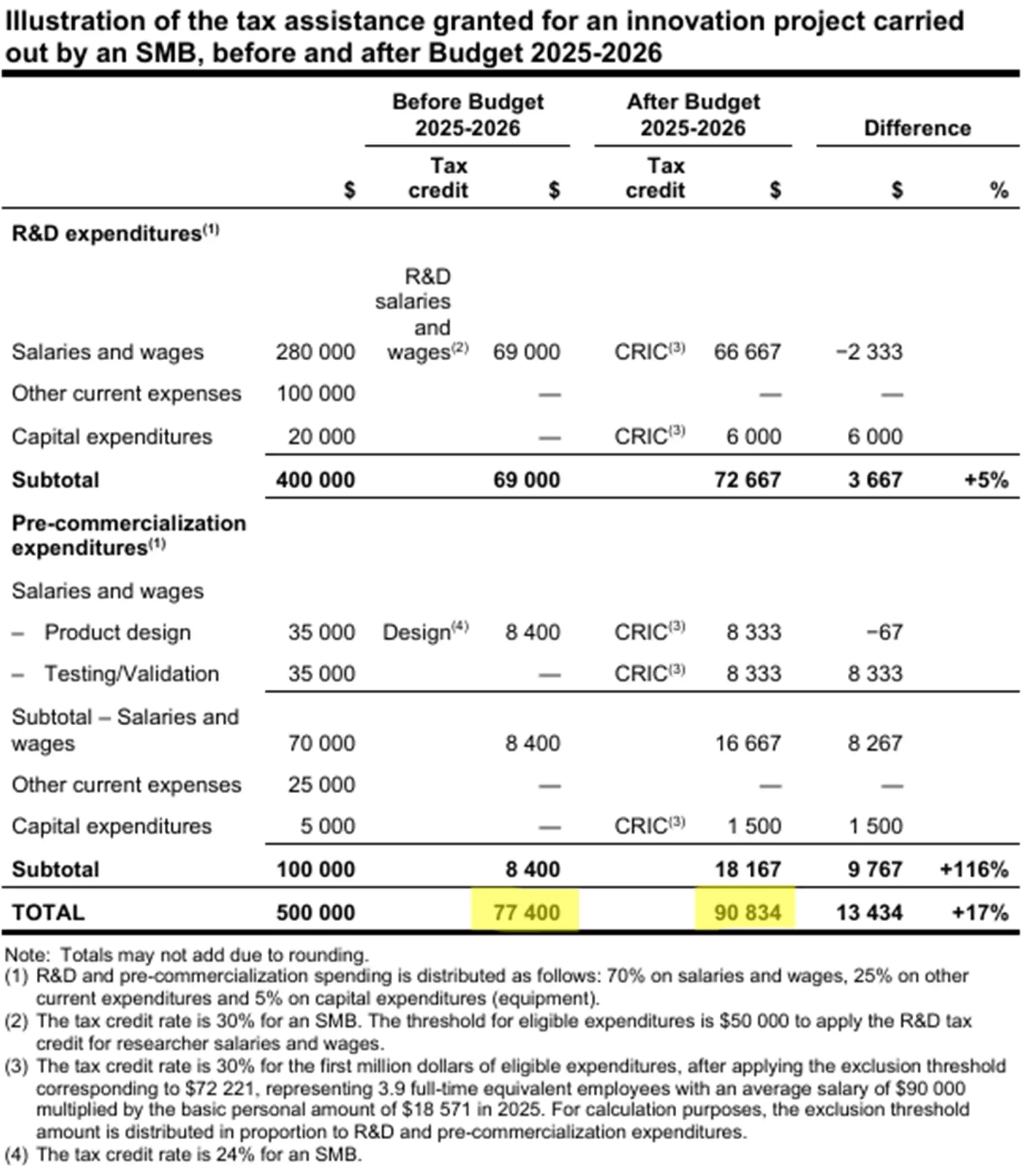

The following two tables illustrate examples of ITC for SMB and Large businesses, comparing calculations with the abolished tax credit and the new Québec CRIC tax credit.

The chart below compares the effective rate of R&D tax assistance before and after the Budget 2025-2026 for SMBs and Large Businesses. For SMBs, it shows an increase of 0.6%, rising from 57.9% to 58.5%; while for Large Businesses, it shows an increase of 4.9%, rising from 25.4% to 30.3%.

Will Companies Have to Apply Separately?

No, they won’t. Here’s how the claims process is expected to work:

- Federal SR&ED claim → Submitted to the CRA, as usual.

- CRIC claim → Administered by Revenu Québec, with its own criteria and forms.

Though details are still being finalized. Companies still apply with their corporate taxes, but the forms will change. Companies file their Quebec return, which includes both T2 (CRA) and RQ information.

Strategic Takeaways for Québec Businesses

- CRIC is not a supplement to the provincial; it replaces the four provincial R&D tax credits (researcher salaries and wages, university research, private partnership pre-competitive research and contributions and fees paid to a research consortium).

- The federal SR&ED credit remains unchanged, and companies should continue applying for it through the CRA.

- Refund levels may decrease compared to the old combined rates, especially if a business does not benefit from the enhanced CRIC rate or has a low commercialization component. However, the IDCI’s reduced 2% tax rate on eligible IP income can offset this impact for corporations that hold and commercialize intellectual property, helping to rebalance the overall benefits for R&D-intensive companies.

- SMBs with up to $1 million in eligible expenditures may benefit from the 30% CRIC rate, though they must account for the $50,000 exclusion threshold; making accurate claim modelling essential. With the CRIC, the size of the business (assets) is irrelevant, unlike the old system.

- Businesses should review whether their expenses qualify for CRIC, especially if they involve pre-commercialization or market launch activities, which are newly supported under this credit.

The rules have changed, and so might your refund. Simulate your claim under the new CRIC guidelines to evaluate your eligibility and maximize your claim.

If you have any questions about your eligibility for the SR&ED program or the Québec CRIC tax credit, please reach out to your tax advisor, SR&ED consultant, or contact us directly!