Calculating SR&ED Full-Time Equivalent (FTE) numbers: Lines 632-638

On Lines 632, 634, 636, and 638 the Canada Revenue Agency (CRA) requires that all Scientific Research and Experimental Development (SR&ED) claimants list how many SR&ED full-time equivalent (FTE) personnel worked on the SR&ED project(s) being claimed. These lines can be misleading as the term “full-time equivalent” has a slightly different meaning within the SR&ED program than it does under regular employment circumstances.

What does Full-Time Equivalent (FTE) mean?

Within the workforce, an FTE is:

“[…] an employee’s scheduled hours divided by the employer’s hours for a full-time workweek. When an employer has a 40-hour workweek, employees who are scheduled to work 40 hours per week are 1.0 FTEs. Employees scheduled to work 20 hours per week are 0.5 FTEs.”1

In the context of SR&ED, the calculation of FTE numbers follows a different methodology. In SR&ED, FTEs are determined by considering the time an individual dedicates exclusively to SR&ED-related tasks.

How to Calculate SR&ED Full-Time Equivalent Numbers

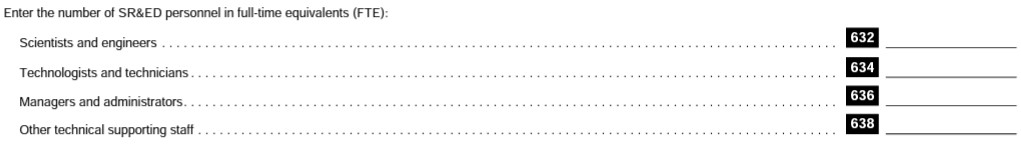

On Part 7 – Additional information, of the T661 tax form, the number of Scientists and/or Engineers, Technologists and/or Technicians, Managers and/or Administrators, and other technical supporting staff involved in the SR&ED project(s) are entered on Lines 632-638:2

To calculate the number of FTE personnel for SR&ED the SR&ED allocation percentage for all employees is added up based on the type of personnel.

Ideally, an organization should carefully track employee time using timesheets. If this is not possible, an alternative approach to determining the time for each employee is using a cost allocation method:

“An SR&ED cost allocation method is a systematic approach to determining which expenditures, or portion of expenditures, relate to SR&ED work. A claimant must be able to show that the cost allocation method used is based on a systematic approach and provide a reasonable level of accuracy in calculating the SR&ED expenditures. Documentation should be kept to identify the key elements of the cost allocation method, including the controls that were used in preparing the claim.

The level of detail and sophistication of books and records will depend on many factors, such as the size of the claimant’s organization, the claimant’s knowledge of SR&ED policies and practices, and the size of the claim. A small business may have less sophisticated financial control systems than a large company, due to the nature of its business or because of cost constraints. A first-time claimant may have an informal system of calculating SR&ED labour expenditures, while an experienced claimant may have a more sophisticated system. Where a large organization may rely on a combination of the methods discussed in this chapter, some small businesses may have to rely on informal, naturally generated information to support their allocation of labour costs to SR&ED projects. In all cases, documentation of the labour effort and the related financial information is required to support the reasonableness of the expenditures included in a claim.”3

An individual who spent half of their working hours on SR&ED work and half on non-SR&ED work would have a 50% SR&ED allocation, and if an individual spent all their working hours on SR&ED work, they would be listed as having a 100% SR&ED allocation. It is better to have a well-documented cost allocation method to determine each individual’s SR&ED involvement, especially if you are claiming many individuals on Lines 632-628 or are claiming high salary or wage expenditures for SR&ED. See our article “Why do I need contemporaneous documentation for SR&ED?” to learn more about why supporting documentation can make or break your SR&ED claim.

Example

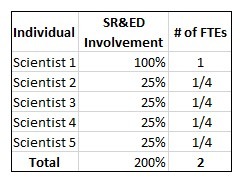

If there were five scientists and engineers engaged in the SR&ED work for the tax year, but only one worked solely on SR&ED projects and the remaining four devoted only one-quarter of their working time to SR&ED, then to calculate the FTEs for Line 632 the claimant must add each individuals involvement together:4

In this example, the claimant would put 2 FTEs on Line 632.

Why is the FTE Important to the CRA?

If the CRA believes the number of personnel claimed in these lines can not be justified by the work described in the technical narrative in Lines 242, 244, and 246 on Part 2 of Form T661, then the CRA is likely to select the claim for a review.

Certain FTE entries may raise red flags for the CRA:

A Large Number of Managers and/or Administrators: If a large number of FTEs are listed in Line 636 the CRA will likely question why. The SR&ED Salary or Wages Policy says the following about Manager involvement:

Managers and supervisors who supervise the ongoing SR&ED work are also considered to be directly engaged in SR&ED when they are directing the course of the ongoing SR&ED work or when they are providing direct technical input into the SR&ED work. However, any time spent by a manager or supervisor performing non-technological management activities or decision-making functions that do not directly influence the course of the SR&ED, even if it relates to the SR&ED, is not considered to be time the manager or supervisor is directly engaged in SR&ED. In most cases, work performed beyond the first-line level of supervision does not qualify as directly engaged in SR&ED. Where time is claimed for employees beyond the first-line level of supervision, the claimant will be asked to provide details of the duties the employees performed during the time they were directly engaged in SR&ED. The claimant will also have to demonstrate how these duties are “directly engaged,” as described above.5

As most managers and administrators are not directly involved and performing SR&ED work but rather offer support or guidance, the CRA will be wary if they see a large number of FTEs on Line 636. Be sure that the SR&ED percent allocation associated with these individuals can be justified and demonstrated to the CRA.

Large Overall FTE Numbers: If an SR&ED claimant is claiming only one SR&ED project for the fiscal year but has listed 25 FTE SR&ED personnel as being involved in that project on Lines 632-638, the CRA may question what all those individuals’ roles were and if they were necessary. This is especially true if the amount and effort of the work described in the technical narrative is deemed insufficient.

Conclusion

The section for Full Time Equivalents (Lines 632-638) are used by the CRA to help determine if the SR&ED costs are reasonable. Ensuring this is calculated correctly is essential. This way, if your claim is chosen for review by the CRA, they can see exactly where each individual’s involvement amount comes from and how they were involved. If you are unsure about the FTEs related to your SR&ED claim, we are here to help!

Comments are closed.