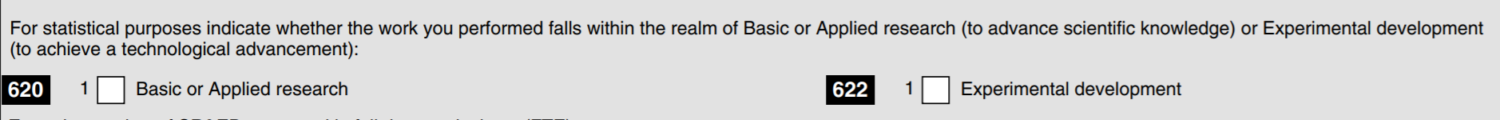

Line 620 or Line 622? The Purpose of SR&ED Work

Filling out Line 620 and Line 622 is necessary to indicate what you are claiming for SR&ED: basic or applied research, or experimental development. In the CRA’s definition of SR&ED, basic research, applied research and experimental development are separate. Select the one that best reflects the work performed in the reported year.

While it may seem that your project included both, try to only pick one. However – which one “best reflects your project work”?1 This post outlines the difference between the two.

Line 620: Basic or applied research

Basic research is “work undertaken for the advancement of scientific knowledge without a specific practical application in view.”2 On the other hand, applied research is “work undertaken for the advancement of scientific knowledge with a specific practical application in view”.3 If your project attempted “to gain new scientific knowledge by advancing the current understanding of scientific principles, methodologies, or relations”, check off the box next to Line 620. 4

Remember, the advancement of scientific knowledge is the “generation or discovery of knowledge that advances the understanding of science.” that the current knowledge base allows. 5 Even if your project did not achieve the desired results, it can still qualify as an advancement because “rejection of a hypothesis is advancement because it eliminates a possible solution”. 6

If your project’s results were published in “scientific journals and other peer-reviewed publications”, then this indicates you undertook basic or applied research. 7

Line 622: Experimental Development

If your project was attempting to achieve “a technological advancement for the purpose of creating new materials, devices, products, or processes, or to improve existing ones”, check off the box beside Line 622. 8

Experimental development differs from basic or applied research because it is “conducted for the purpose of achieving technological advancement. In other words, the work is conducted for the generation or discovery of knowledge that advances the understanding of technology.”9 Thus, if your work generated or discovered “knowledge that advances the understanding of science or technology. The type of knowledge in this context is conceptual knowledge, such as theories or prediction models, rather than just factual knowledge, such as data or measurements.”, you achieved experimental development (good job!).10

Experimental development leads to an advancement in your understanding of the technology. Technology is “the practical application of scientific knowledge and principles”.11 If your project unearthed “knowledge of how scientifically determined facts and principles are embodied in the material, device, product, or process.”, your SR&ED work was likely technological development. 12

What if the purpose of the SR&ED work is both basic/applied research and experimental development?

This instance is very rare, so don’t check both boxes unless you have hard proof that both basic or applied research and technological development occurred. The overwhelming majority of the time, you will just pick one box.

What if there were multiple projects in the reported year?

If you are reporting multiple SR&ED projects, and some “involve experimental development and others involve basic or applied research”, you should check off both boxes.13

Summary: The Purpose of SR&ED Work

Line 620 and 622 ask a question that requires you to know your project and objectives: what was the purpose of your work? However, the important part of answering Line 620 and 622 is that you avoid unnecessarily checking off both boxes. An event in which both basic/applied research and technological development occurred is uncommon. Choose one.