Fine or Fined? Listing your SR&ED Claim Preparers (T661 Part 9)

Updated to Reflect New Policies (2022)

*** Some of the policies referenced were updated 2021-08-13. This article has been updated and is accurate as of 2022. ***

T661 Part 9: Listing your SR&ED Claim Preparers

When applying to the Canada Revenue Agency for Scientific Research & Experimental Development (SR&ED) investment tax credits, the information you provide in each section can ultimately decide its fate in the hands of a discerning CRA agent. Make sure you are on target for a successful application by considering the information provided below.

T661 Part 9: SR&ED Claim Preparer Information

Part 9 of your SR&ED claim is a non-negotiable section of your T661. For each SR&ED claim where information about the claim preparers is missing, incomplete or inaccurate, a “penalty of $1,000” will be issued.1 Here, the CRA really isn’t messing around!

Both the claim preparer and the claimant are liable if the information is inaccurate in Section 9. However, taxpayer relief provisions are available if extraordinary circumstances are present.2 Also, if it is proven that claim preparers “exercised the degree of care, diligence, and skill that a reasonably prudent person would have exercised” they may be exempt from liability. 3

Filling Out The Table

If the claimant had another business/individual involved in “any aspect” of the T661 application, you must check box 1 at Line 935.4 If the claimant filled out their own T661 report, then they check box 2, indicating no individual or business was involved. 5

If you’re unsure who qualifies as a claim preparer, it is someone who the claimant contacted “to prepare or assist in the preparation of the form but does not include an employee” who was fulfilling their duties as an employee by filling out the T661 application.6

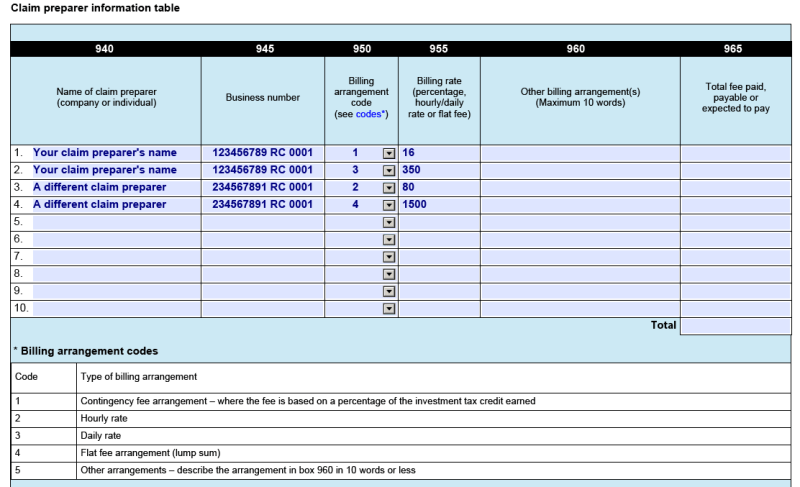

Line 940 is where you enter the claim preparer’s name. Enter multiple claim preparers on separate lines. If there were multiple billing arrangements with whoever prepared the T661 (e.g., a flat rate of $1000, and an hourly fee of $80), enter the same business on two separate lines to show there were two separate billing arrangements. This method is also used if the claim preparer had a “contingency fee arrangement with variable rates”.7

Line 945 is where you enter the business number (BN) or HST/GST for the claim preparer whose name you entered in Line 940. If the claim preparer is a corporation or business, enter the business number, and if the claim preparer is an individual, enter their HST/GST. Ensure that if you are entering a BN, you enter all fifteen characters in each line where the business’s name has been entered.

Line 950 is where you enter the billing codes the CRA has assigned for billing arrangement types. Enter the amount paid in Line 955. The billing codes and the format which you are required to use to enter the billing codes and the amount paid are explained in detail below:

- 1 represents a contingency fee agreement where a claim preparer charges a percentage of the investment tax credit that the claimant receives.8 Any “reference to ITC within the SR&ED program” refers to investment tax credit earned within the SR&ED program unless stated otherwise.9 For example, if the claim preparer charged 16% of the ITC, one would enter “1” at Line 950 and “16” in at Line 955 in the row next to the claim preparer’s name.

- 2 represents “hourly” payment.10 If your claim preparer charged $80 an hour then you enter “2” at Line 950 and “80” in Line 955.11

- 3 stands for daily rate of payment: if the claim preparer charges $350 daily, enter “3” in Line 950, and “350” at Line 955.12

- 4 stands for a lump sum or “flat fee arrangement”: for example, if you’re charged upfront for $1500, you enter “4” in Line 950 and you enter “1500” in Line 955. 13

- 5 stands for a billing arrangement that does not match any of the descriptions above: you must describe, with “10 words or less”, the arrangement that transpired in Line 960.14

If the claimant and claim preparer settled on a “contingency fee arrangement with a variable rate (increasing or decreasing), indicate the name of the claim preparer and the various rates on separate lines.”15 For example, if the claim preparer charges 10% on the first $10,000 received and 7% for each $2000 received afterward, then this information should be entered like so:

Line 965 is where you enter the total sum of money paid, “payable or expected to be paid” to each of the claim preparer(s), and the total money paid to all claim preparers. 16

In Lines 970 and 975, you must enter the name of the “individual, authorized signing officer of the corporation, or authorized partner” who certifies the information about the claim preparer is correct and complete: in Line 975, they are also required enter their signature and the date they signed.17

If you’re filing your T661 electronically, you enter “three items of identification—the Business Number, tax year-end, and web access code or EFILE online number and password” as your official electronic signature.18

Privacy Concerns About Section 9

Part 9 asks for private information from contracts you made with claim preparers. Requiring SR&ED claim preparers to expose their fee structures makes them an easy target for audit groups and can complicate non-disclosure agreements between claimants and claim preparers.19

The CRA allows a stipulation if privacy is a concern: the claim preparer provides a complete T661 form with only Lines 935, 940, 945, 970 and 975 from Section 9 completed. Then, the claim preparer submits a separate T661 form with only Section 1 and Section 9 “completed in their entirety for each claim preparer”.20 Then you are required “send Parts 1 and 9 directly to your tax centre at the same time you file your return”.21

You can access more non-privacy-related concerns about the current Part 9 here and here.

Summary: SR&ED Claim Preparer

Part 9 is a complex and important part of the T661 application form. It is also the most controversial, and for good reasons. Regardless, make sure you complete it diligently.