CRA Policy Review – SR&ED Salary or Wages

The numerous and detailed Scientific Research and Experimental Development (SR&ED) related policies can be overwhelming. In an effort to make the inner workings of the SR&ED program more understandable we have examined some of these policies and summarized them for our readers. This summary pertains to the SR&ED Salary or Wages Policy.

Salaries and wages typically make up the largest portion of SR&ED claims. It is therefore important to understand which costs can be included when submitting a claim for SR&ED.

What salary or wage expenses can be claimed for SR&ED?

The Income Tax Act (ITA) defines salary or wages as income from an office or employment.1 For the purpose of SR&ED, salary and wages include the following amounts of which we will examine in more detail below.

- Salary or wages

- Taxable benefits

- Bonuses

- Remuneration based on profits

- Inducements, non-competition payments2

Salary or Wages

The policy states that an employee’s salary or wages are only included:

- If it is incurred on or in respect of SR&ED.

- If electing the proxy method, salary or wages for employees directly engaged in SR&ED in Canada may be included

- If using the traditional method, salary or wages for employees directly undertaking, supervising, or supporting SR&ED may be included and,

- Administrative salary or wages for employees directly attributable may be included as SR&ED overhead and other expenditures (provided the traditional method is used)

- Permissible salary or wages for SR&ED work performed outside Canada may be included in some circumstances.3

Taxable Benefits

The policy states that taxable benefits may be in either cash or non-cash form. Cash benefits may be included in SR&ED salary or wages and can include housing or board, meals, gifts and awards, and other items. Non-cash benefits are benefits that the employee receives from the employer that are not calculated on a strict invoice-payment method but rather are a physical benefit which is calculated by the value of the benefit.4 For example, if an employee has the use of a company car for transportation the value of that benefit may be calculated and claimed at the end of the year, including gas, insurance, and maintenance. For more information on what may be considered as a taxable benefit please read our previous article Taxable Benefits and SR&ED.

Bonuses and Remunerations

Bonuses, Remuneration based on profits, Inducements, and non-competition payments may be included within an employee’s salary or wages if the employee is non-specified. For more information on the definition and rules about specified employees please see our previous post Specified Employees in SR&ED: Rules and Regulations. The rules regarding bonuses and remunerations are as follows within the SR&ED Salary or Wages policy:

- Bonuses*

- Remuneration based on profits**

- Inducements***, non-competition payments

- Are considered to be remuneration for services rendered during employment (exceptions may apply).5

* Bonuses refer to an ‘unenforceable bonus’ which is a payment that is not earned and if a gift or gratuity.

** Remuneration based on profits refers to an ‘enforceable bonus’ which is an amount paid in recognition of achievements within the employees’ terms of employment.

*** Inducements are also known as signing bonuses

What is excluded in SR&ED salary or wages?

For the purpose of SR&ED an employee’s salary or wages cannot include the following amounts:

- Related benefits

- Extended vacation or sick leave

- Stock option benefits

- Retiring allowance6

Traditional Method Exceptions to the Exclusions

If the taxpayer is using the traditional method for their tax return, then there are two exceptions to the above list. Under the traditional method, the taxpayer may be able to treat related benefits and retiring allowances as Overhead and Other Expenditures on line 360 of Form T661. Under the traditional method, such contributions are general business expenses that can only be SR&ED overhead and other expenditures if they are directly related and incremental to the prosecution of SR&ED in Canada.7

Allocation of labour expenditures for SR&ED

In order to track and allocate SR&ED work and the related costs as a project progresses, SR&ED claimants must implement a cost allocation method. The policy states that “An SR&ED cost allocation method is a systematic approach to determining which expenditures, or portion of expenditures, relate to SR&ED work.“8. The CRA states that “as long as they are reasonable within the context of a claimant’s research and development (R&D) environment, are documented, and are effectively and consistently applied“9, cost allocation approaches will generally be acceptable.

Labour allocation information can be summarized at high, medium, and low levels. First, high-level information is “The documentation of a business’s overall corporate and strategic objectives“10. Then, Medium-level information is “generated at the project level and generally relates to a business’s documentation of specific work efforts“11. Finally, low-level information is “Information related to individual tasks“12. The CRA may need to review the information at more than one level to properly evaluate whether the allocation method chosen is reasonable or not. The type of R&D environment the project is completed in will determine what level of cost allocation method is reasonable, as each type of environment will provide different sources of evidence as support. The four R&D environments discussed include:

- distinct well-defined R&D projects;

- dedicated R&D environments;

- early stage or start-up business;

- shop floor R&D.13

Distinct well-defined R&D projects

An R&D environment designated as a ‘Distinct well-defined R&D project’ means the claimant’s organization assigned personnel and resources to specific R&D projects. In this type of environment all projects have a defined start date, targeted finish date, and are based on well-defined technological objectives. The core project is SR&ED, the support work is necessary to resolve the technological challenges, and the work effort can be allocated completely to the project. Supporting information in this setting may include:

- resource allocation or utilization summaries;

- project cost control systems;

- supervisor summaries;

- Gantt charts;

- time lines.14

Dedicated R&D environments

An R&D environment designated as a ‘Dedicated R&D environment’ means a defined group of personnel are focused exclusively on R&D for new products or processes, typically to the exclusion of all other business activities. Within this type of environment, usually large multidisciplinary businesses, a dedicated research department may be present. These research departments may involve SR&ED and non-SR&ED work, therefore supporting documentation will be required to show cost allocation process(s). Supporting information in this setting may include:

- supervisor summaries;

- resource allocation or utilization summaries;

- Gantt charts;

- time lines;

- time sheets.15

Early stage or start-up business

An R&D environment designated as an ‘Early stage or start-up business’ means the environment’s purpose is to develop new products or processes. The personnel in this environment may be focused on only one SR&ED project, and therefore the simplest approach would be to identify employees working on non-eligible work and subtract that portion of labour expenditures from the total labour expenditures. Supporting information in this setting may include:

- job descriptions;

- development plans;

- Gantt charts;

- supervisor summaries;

- time sheets.16

Shop floor SR&ED

If an R&D environment is designated as ‘Shop floor SR&ED’ then the purpose within that environment is the creation or improvement of new or existing materials, devices, products, or processes. Such an environment may be located in the field or at a commercial facility and may involve a variety of employees from different parts of an organization.

Supporting information in this setting may come in the form of timesheets, a time clock system, or other methods of employee time tracking. It is encouraged that claimants develop a process to collect this information at the start of a project, otherwise, difficulties may be encountered in supporting the time an employee spends performing SR&ED work due to the variety of employees involved in shop floor SR&ED.17

What is the Salary Base?

Salary or wages are taken into account to calculate a taxpayer’s salary base, it is important claimants’ have an understanding of the difference between the salary base and salary or wages, including what they may or may not include within them. The CRA’s SR&ED Glossary defines the salary base as:

an amount used to calculate the prescribed proxy amount (PPA). The PPA for a tax year is a percentage of the salary base, subject to the overall PPA cap.

The salary base is composed of the salaries or wages (incurred and paid in the tax year or paid within 180 days of the tax year-end) of employees who are directly engaged in SR&ED and that are included in the pool of deductible SR&ED expenditures. However, the salary base cannot include taxable benefits, remuneration based on profits, or bonuses, or prior years’ unpaid salary or wages paid in the tax year. In addition, the amount of salary or wages that can be taken into account is further restricted for a specified employee.[18. Canada Revenue Agency. (August 13, 2021). SR&ED Glossary: Salary Base. https://www.canada.ca/en/revenue-agency/services/scientific-research-experimental-development-tax-incentive-program/glossary.html#g19.]

The Salary Base in Your Tax Claim Forms

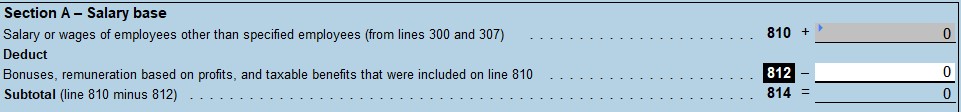

In Part 5- Calculation of prescribed proxy amount in the T661 – Scientific Research and Experimental Development (SR&ED) Expenditures Form, the salary base must be calculated first in order to calculate the PPA and PPA cap. As seen below, line 810 is where the salaries or wages are auto-populated from lines 300 and 307. In line 812 the amount of taxable benefits, remuneration based on profits, or bonuses, or prior years’ unpaid salary or wages paid in the tax year is entered. Line 812 is then deducted from line 810, calculating the salary base into line 814.

For more information on the Prescribed Proxy Amount please read our previous article Proxy vs. Traditional SR&ED Claim: Which Method to Choose. Our previous article What is the Prescribed Proxy Amount (PPA) Cap? can give you further information into how the PPA and PPA cap may affect your tax return.

Salary or Wages Outside Canada

While SR&ED is a program for Canadian companies, it may be possible to claim a portion of an employee’s salary or wages who has carried out SR&ED work outside of Canada. These salaries or wages can only be claimed up to a certain amount, and the SR&ED work must be completed by an actual employee, not contractors. To determine the amount that can be claimed as permissible salary or wages for SR&ED carried on outside Canada:

Claimants will first have to calculate the two amounts A and B below. The lower of amount A or B can be claimed as the permissible salary or wages for SR&ED carried on outside Canada.

- Amount A – Total of salary or wages for SR&ED work carried on outside Canada

- The salary or wages that can be claimed for SR&ED work carried on outside Canada must meet the following criteria:

- the costs were incurred after February 25, 2008;

- the SR&ED work was directly undertaken by an employee of the claimant and not performed by a contractor;

- the employee who performed the SR&ED work was a resident of Canada at the time the expense was incurred;

- the work was related to a business of the claimant;

- the SR&ED work carried on by the employee outside Canada was an integral part and solely in support of the SR&ED work carried on in Canada (see section 10.2.1); and

- the salary or wages paid were not subject to income or profits tax from another country (see section 10.2.2).

- Amount B – 10% of the total of SR&ED salary or wages for SR&ED carried on in Canada

- This limit is calculated as 10% of the total salary or wages claimed for SR&ED carried on in Canada (see section 10.2.3). Note: Although the Income Tax Act refers to an expense incurred in the year for salary or wages paid to an employee in respect of SR&ED, it is the practice of the CRA to use the amount on line 306 of Form T661 (expenditure incurred) for the purposes of determining the 10% limit.18

Conclusion

The CRA SR&ED Salary or Wages Policy explains all the amounts which may or may not be included in an employee’s salary or wages for SR&ED purposes for the tax year and clarifies the CRA’s position concerning issues that are common to both the traditional method and the proxy method. For further details and to see the policy in its entirety see SR&ED Salary or Wages Policy on the Government of Canada website. We will do our best to keep our readers up to date on any policy changes or amendments.