The Alberta Innovation Employment Grant: Details and Guide

On July 22, 2020, Premier Jason Kenney, Finance Minister Travis Toews, and Economic Development, Trade and Tourism Minister Tanya Fir revealed the Innovation Employment Grant (IEG) for Alberta during a news conference. In this post, we explain how the IEG works, and who may claim it. We offer insight into how this new grant affects Scientific Research and Experimental Development (SR&ED) claimants, a guide on how to fill out the prescribed forms, and what you need to be aware of during this process.

Innovation Employment Grant (IEG)

The IEG was announced on July 22, 2020, as a way to help small and medium-sized businesses and support these job creators at every stage of their development, including their start-up phase when they aren’t reporting profits but they’re in that critical phase that so many start-ups don’t make it through. The program officially began on January 1, 2021, and includes:

- an 8% payment for eligible R&D spending carried out in Alberta, up to the corporation’s base level of spending.

- an enhanced 20% payment for eligible R&D spending that exceeds the corporation’s base spending level.

- A firm’s base level of spending is determined by calculating the corporation’s average qualifying R&D spending over the previous 2 years.1

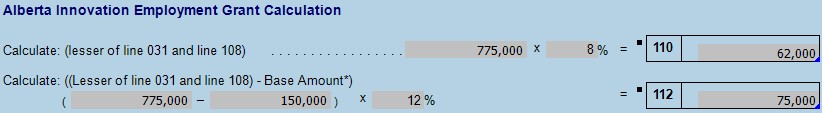

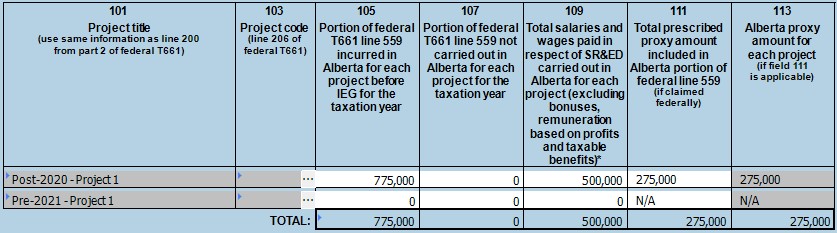

The 20% is calculated on AT1 Schedule 29- Alberta Innovation Employment Grant by calculating the initial 8% payment and then an additional 12% payment is calculated after the company has exceeded their base spending level:

We will explore the details and the exact calculations used to determine the total grant receivable later in this article.

IEG Eligibility

This grant is targeted toward small and medium-sized businesses that undertake R&D within Alberta. Companies will begin to be phased out of the program once their taxable capital reaches $10 million and fully phased out once their taxable capital reaches $50 million.2

The eligible expenditures claimed must have been incurred in Alberta after December 31, 2020, and match those that qualify, and are also claimed, for the companies SR&ED Tax Incentive Program claim for their fiscal year:

As this grant is based on expenditures that also qualify for the federal SR&ED program, payments will not be processed until qualifying expenses have been verified by the Canada Revenue Agency and are confirmed to have been undertaken in Alberta by Tax and Revenue Administration.3

While this grant is not administered by the CRA, it is only awarded to SR&ED claimants, therefore to claim the IEG you must also, or have previously, claimed SR&ED for the tax year.

IEG filing deadline

The filing deadline for the Innovation Employment Grant is 15 months after the day on or before which the corporation is required to file its AT1 for the year.4 Alberta taxpayers are required to file their AT1 within 6 months of the corporation’s tax year-end.5

This means the final deadline for the Alberta IEG is within 21 months of the company’s fiscal year-end. The filing deadline for the Alberta IEG is later than the federal SR&ED filing deadline of 18 months past the company’s fiscal year-end. See Can you apply for the SR&ED credit past the filing deadline? to learn how the federal SR&ED filing deadline works. Keep in mind that the IEG is based on expenditures that also qualify for the federal SR&ED program, therefore IEG payments will not be processed until qualifying SR&ED expenses have been verified by the CRA and are confirmed to have been undertaken in Alberta by Tax and Revenue Administration.6 This means claimants must file their SR&ED forms at the same time or before they file their IEG forms.

If your company’s Tax year-end for F2021 was December 31, 2021, then you have until September 30, 2023, to file for the IEG. Don’t miss your deadline to file!

IEG Calculations Example

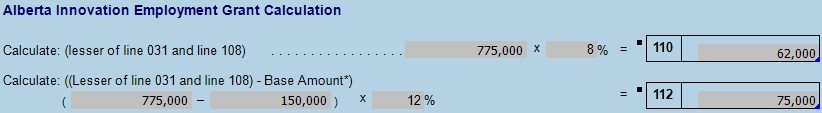

If SR&ED claimants within Alberta wish to claim the IEG then they must select one of two boxes to show they are eligible for the grant. These boxes are found on Schedule 60 – T661 Part 2:

The claimant must indicate whether their expenditures were incurred “After December 31, 2020” or “After December 31, 2020, and before January 1, 2021”. If neither box is checked then the IEG amounts will not transfer over to the T661 form.

Form A29 LISTING – Listing of Innovation Employment Grant Projects Claimed in Alberta

Once a box has been selected this project will be carried over to Form A29 LISTING – Listing of Innovation Employment Grant Projects Claimed in Alberta.

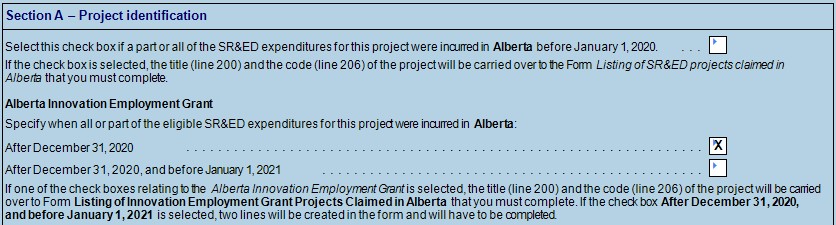

The project title and code for each SR&ED project being claimed will prepopulate on this form. If the box “After December 31, 2020” was selected on Sch 60 then each project will have one row to fill in, and if the box “After December 31, 2020, and before January 1, 2021” was selected then that project will have two rows of information to fill in. One row for “Post-2020” and one row for “Pre-2021”:

The next step is to fill in Lines 105-111 for each project:

Line 105: In this Line, the claimant must enter the in-province portion of Line 559 associated with each project.

Line 107: In this Line, the claimant must enter the out-of-province portion of Line 559 associated with each project.

Line 109: In this Line, the claimant must enter the total SR&ED salaries and wages paid for work carried out within Alberta for each project.

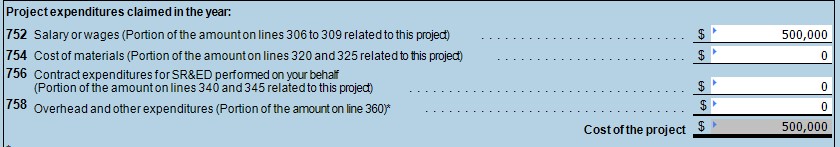

- If all the costs were related to work carried out in Alberta, then this amount will also be listed on Line 752 of Sch 60:

- If a portion of the work was carried out out-of-province, then the amounts to enter on Line 109 will need to be manually calculated. This is where the proper documentation and supporting evidence becomes crucial. See our article Why do I need contemporaneous documentation for SR&ED? for more information.

Line 111: In this Line, the claimant must enter the total prescribed proxy amount (PPA) related to the portion of the project carried out in Alberta for each project.

- If any portion of the work was carried out out-of-province, then the PPA to enter on Line 111 will need to be manually calculated.

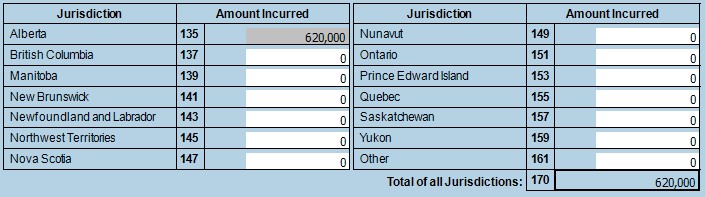

The in-province amounts entered in Lines 105-111 will populate in Line 135 of Form A29 LISTING and the claimant must enter any out-of-province expenditures on Lines 137-161, each of which correspond with a different Canadian province:

The total expenditures will calculate in Line 170 and this amount should match Line 570 on Sch 32 – T661 SR&ED Claim Form. Always be sure to quadruple-check your calculations and keep proof of them in case of a CRA review.

Form A29 – Alberta Innovation Employment Grant

The amounts from Form A29 – Listings will prepopulate into Form A29 on Lines 005-009:

The total eligible expenditures for IEG purposes are calculated by:

- Subtracting the Alberta PPA (Line 007) from the Portion of Line 559 incurred within Alberta (Line 005).

- $638,000-$275,000=$363,000

- Adding the Alberta PPA (Line 007), the IEG that reduced the federal expenditures in Line 559 of Sch 32 (Line 011), and the Alberta portion of any repayment of government assistance or contract payment made in the tax year and relating to SR&ED (Line 025):

- $363,000+$275,000+$137,000+$0=$775,000

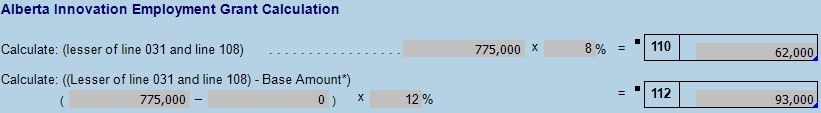

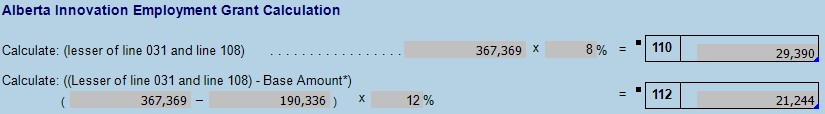

The Total Eligible Expenditures for Alberta Purposes ($775,000) are used to calculate the IEG in the “Alberta Innovation Employment Grant Calculation” section of Form A29. These calculations occur in Line 110 and Line 112 if the company is eligible for the full 20% grant:

The initial 8% IEG rate is calculated in Line 110 by multiplying the Total Eligible Expenditures for Alberta Purposes ($775,000) by 8%:

- 8% of $775,000 = $62,000

If the company is qualified then they may earn 12% of eligible expenditures over their base level of spending. This amount is calculated in Line 112 by multiplying the Total Eligible Expenditures for Alberta Purposes ($367,369) less the company’s base level of spending amount by 12%:

- $775,000-$150,000 = $625,000

- 12% of $625,000 = $75,000

If the corporations’ eligible expenditures incurred in Alberta for the year are below their base level spending then only Line 110 will calculate.

The final IEG available to the claimant is the amount of Line 110 plus the amount of Line 112:

- $62,000+$75,000 = $137,000

Base Amount Calculation

Calculating the base-level spending can be a bit confusing. It is calculated based on the corporation’s previous two years’ eligible expenditures. For example, if the corporation was claiming SR&ED for the first time then they would have 0$ base level expenditures and would be eligible for the entire 20% automatically as $0 would be subtracted from the Total Eligible Expenditures for Alberta Purposes in Line 112.

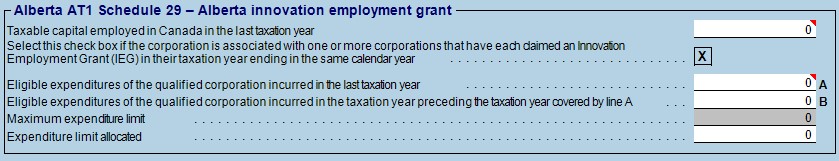

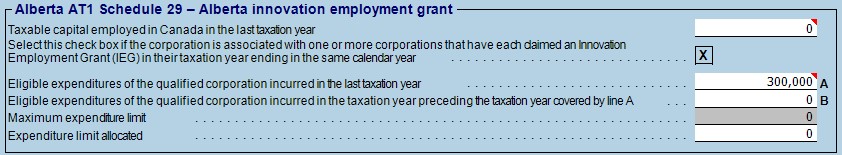

The base level spending amount is calculated on Form A29 in Lines 114-118, but first, the claimant must enter their “Eligible expenditures for the first preceding year” and their “Eligible expenditures for the second preceding year” on the Form Sch 9 Workchart – Related and Associated Corporations Workchart in the section “Alberta AT1 Schedule 29 – Alberta innovation employment grant”:

- The claimants’ “Eligible expenditures for the first preceding year” is manually entered into Line A which then populates into Line 114 of Form A29, and;

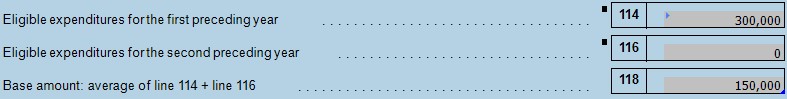

- The claimants’ “Eligible expenditures for the second preceding year” is manually entered into Line B which then populates into Line 116 of Form A29:

- The average of the amounts in Lines 144-116 is the Base level spending amount, which calculates in Line 118 of Form A29.

In this example, the Base amount of $0 would then impact the final IEG calculations in Lines 110 and 112:

- 8% of $775,000 = $62,000

- $775,000-$0 = $775,000

- 12% of $775,000 = $93,000

- $62,000+$93,000 = $155,000

In this example, the final IEG available to the claimant would be $155,000. The final IEG amount transfers into the T661 on Lines 429 and 513 and counts as a refundable amount.

In the example posed first in this article (see above in Section “Form A29 – Alberta Innovation Employment Grant”) the company did have eligible expenditures in previous taxation years. The amount of $300,000 was entered into Line A of the Sch 9 Workchart:

- In this example the claimant’s “Eligible expenditures for the first preceding year” is $300,000, and is entered into Line A which then populates into Line 114 of Form A29, and the claimant has no “Eligible expenditures for the second preceding year” therefore Line B which then populates into Line 116 of Form A29 is left blank.

- The average of the amounts in Lines 144-116 is the Base level spending amount, which calculates in Line 118 of Form A29 ($150,000)

The Base amount of $150,000 would then impact the final IEG calculations in Lines 110 and 112:

- 8% of $367,369 = $29,390

- $367,369-$190,336 = $177,033

- 12% of $367,369 = $21,244

- $29,390+$21,244 = $50,634

In this example, the final IEG available to the claimant would be $50,634. The final IEG amount transfers into the T661 on Lines 429 and 513 and counts as a refundable amount. For more information on the meaning of refundable see our article A Closer Look at Refundable and Non-refundable SR&ED Tax Credits.

Conclusion

This is exciting news for Alberta as the province eliminated its provincial Scientific Research and Experimental Development (SR&ED) investment tax credits (ITCs) on January 1, 2020. From 2009-2019 the SR&ED ITC rate was 10% in Alberta and the loss of the provincial SR&ED ITCs was difficult for small businesses. The Innovation Employment Grant can be seen as a replacement for SR&ED ITCs in Alberta and may allow companies more money if they increase their R&D spending. The Government of Alberta has published a Guide to claiming the Alberta Innovation Employment Grant for more details. SR&ED ITC rates for all provinces can be found on our page Provincial R&D Credits – Interactive Map.