Federal Budget 2017: Minor Tweaks to SR&ED, Focus on Innovation

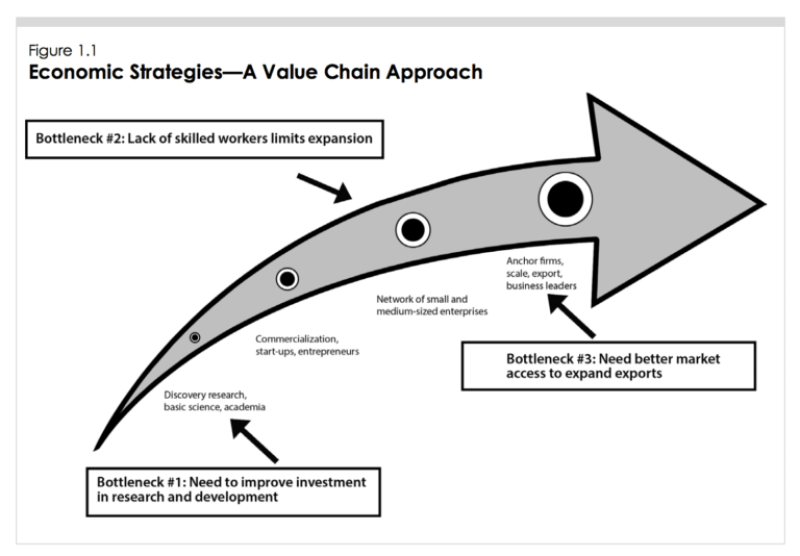

On March 22, 2017, federal Finance Minister Bill Morneau introduced the Liberal Party’s much-anticipated 2017 federal budget, titled “Building a Strong Middle Class”. This is the Liberal Party’s second budget since their election to office in October 2015. In it, the government announced that their focus was partially on the “new, more innovative economy of tomorrow.” This focus is based on recommendations made on February 6, 2017, by the Minister’s Advisory Council on Economic Growth who recently released a report titled “Unlocking Innovation to Drive Scale and Growth”.

SR&ED in the Budget: An Overview

Budget 2017 promises to make several changes to SR&ED, to ensure “its continued effectiveness and efficiency.” The current plan is to initiate a “whole-of-government review of business innovation programs.” In the main budget document, the following appears:

Initiate a whole-of-government review of business innovation programs. To ensure that its programs are simple and effective and best meet the needs of Canada’s innovators, the Government will review existing programs with the help of external experts. The review will encompass all relevant federal organizations, including Innovation, Science and Economic Development Canada, Natural Resources Canada, and Agriculture and Agri-Food Canada. In parallel, the Government will also review the Scientific Research and Experimental Development tax incentive program to ensure its continued effectiveness and efficiency.

In time, Innovation Canada will serve as a one-stop-shop for Canada’s innovators. Canadian innovators and entrepreneurs will no longer need to spend time figuring out which department to go to or which program best meets their needs. Innovation Canada will host the federal government’s simplified suite of innovation programs that will better enable and support Canadian innovators.

The only other reference to SR&ED is a brief bullet point under “Closing Tax Loopholes”:

Clarify the intended meaning of “factual control” under the Income Tax Act for the purpose of determining who has control of a corporation in order to prevent inappropriate access to supports such as the small business tax rate and the enhanced refundable 35-per-cent Scientific Research and Experimental Development Tax Credit for small businesses.

A more detailed explanation appears in the Tax Measures: Supplementary Information document:

MEANING OF FACTUAL CONTROL

The Income Tax Act recognizes two forms of control of a corporation: de jure (legal) control and de facto (factual) control. The concept of factual control is broader than legal control and is generally used to ensure that certain corporate tax preferences are not accessed inappropriately. For example, the factual control test is used for the purpose of determining whether two or more Canadian controlled private corporations are “associated corporations”. Associated corporations must be considered together in determining whether certain thresholds are met, such as the $500,000 small business deduction limit and the limit on qualifying expenditures relating to the refundable 35-per-cent scientific research and experimental development tax credit. A person may have factual control of a corporation even though the person does not have legal control of the corporation.

Legal control of a corporation generally entails the right to elect the majority of the board of directors of the corporation. Factual control of a corporation exists where a person has “directly or indirectly in any manner whatever” influence that, if exercised, would result in control in fact of the corporation. In each situation, consideration of all the relevant factors is required in determining whether there is factual control of a corporation. A significant body of case law has developed concerning which factors may be useful in determining whether factual control exists.

A recent court decision held that, in order for a factor to be considered in determining whether factual control exists, it must include “a legally enforceable right and ability to effect a change to the board of directors or its powers, or to exercise influence over the shareholder or shareholders who have that right and ability”. This requirement limits the scope of factors that may be taken into consideration in determining whether factual control of a corporation exists. It is not intended from a policy perspective that the factual control test be dependent on the existence of such a legally enforceable right, or that factors that do not include such a right ought to be disregarded.

To ensure taxpayers do not inappropriately access certain tax preferences, Budget 2017 proposes that the Income Tax Act be amended to clarify that, in determining whether factual control of a corporation exists, factors may be considered that are not limited to the requirement set out above.

This measure will apply in respect of taxation years that begin on or after Budget Day.

Federal Budget 2017: Final Thoughts

The Liberal Party’s second budget since coming into office treads carefully and does not propose any dramatic changes to the Scientific Research and Experimental Development program, although there are hints of change.

Similar to the previous budget this one does appear to be stalling for time. It hints at some steps that the government will take in the future (after conducting additional reviews) but does not propose any sweeping changes.

At this time, we would strongly advise companies who may be affected by the clarification of the meaning of factual control to contact their legal and accounting teams, to ensure they remain eligible for the enhanced tax credit rate.